FINAL PAY COMPUTATION (SAMPLE) OF RESIGNED EMPLOYEE BASED ON. How long is the final pay due? Why do bosses ask to leave after resignation? Should you be paid after leaving your job? Can an employer pay you for a resignation letter?

One of those modes of cutting employment relationship is resignation. An employee who resigns is not entitled to separation pay. A DOL official will assist you with the process.

If you think that your employer deprived you of your right to resignation notice pay or any other final pay, consider consulting a lawyer. Finally, the Texas Payday Law regulates the timing of the final paycheck in section 61. If an employee is laid off, discharged , fired , or otherwise involuntarily separated from employment , the final pay is due within six (6) calendar days of discharge. If the employee quits, retires, resigns, or otherwise leaves employment voluntarily, the final pay is due on the next regularly-scheduled payday following the effective date of resignation. The first step towards getting your final pay after resignation South Africa is issuing a notification according to the legal rules on minimum notice period.

If an employee quits, wages are due on the next pay period that is more than five days after quitting. However, wages must be paid within days of separation (see Minnesota Statutes 184). Notice and redundancy.

Check annual leave entitlements. It is typically given a month after your last day or after submitting all HR requirements. Here are some more facts about your final pay and other documents you should be receiving when you resign.

The place of final wage payment for employees who quit without giving hours prior notice and who do not request that their final wages be mailed to them at a designated address, is at the office of the employer within the county in which the work was performed. Labor Code Section 208. If you are resigning to take on another job, your employer may ask what salary it would take to keep you in the fold. There may be times when you need to get an employee away from the workplace immediately upon resignation. Some states require the employer to provide a terminated employee’s final paycheck immediately or within a certain time frame, such as the following payday.

And in some states, the final paycheck laws depend on whether the employee was fired or quit. As an employer, you must follow your state’s final paycheck laws. Upon the termination of employment, employers are typically obligated to pay the terminated employee their final pay , prepare a Tslip and complete a Record of Employment (ROE).

When it comes to the final pay or termination pay , there is a “reasonable time period” for employers to administer the payment after the employee is terminated. This makes it particularly important that you understand the rules related to how the final paycheck should be paid and what it should include. The final paycheck is often your final official contact with a former employer.

The law is there to protect employer and employee rights, whether you have quit your job or been let go. Payment of wages due. Termination pay means the payment legally due to your employee when she leaves your employ. Your notice period is counted from the day of resignation or termination.

In case of termination, the employer might ask you to work during the notice period or pay you the salary for the period. Annual leave is considered compensation equivalent to cash. As a result, when you leave the federal government you can cash-out your annual leave. If you have hours of annual leave when you quit, you will receive two days of pay added to your final paycheck.

This is treated the same whether you quit or retire. Is there any such distinction or is the final pay following either event not subject to superannuation? Unconditional payment of wages conceded to be due. California labor law penalizes employers that withhold earned pay from their employees on termination or resignation. You can pay final wages via direct deposit if an employee previously authorized direct deposit for wages.

Keep in mind that payment of final wages by direct deposit may not be practical. For example, unless an employee quits precisely hours prior to payday (and the payroll can include all unpaid vacation in the check), a direct deposit of the final paycheck will likely be late. The employer must pay out the full notice period that applies for dismissing an employee. It’s worth noting that any time the employee has already worked during the resignation notice period doesn’t count. The amount paid must equal the full amount the employee would have been paid if they worked the full notice period.

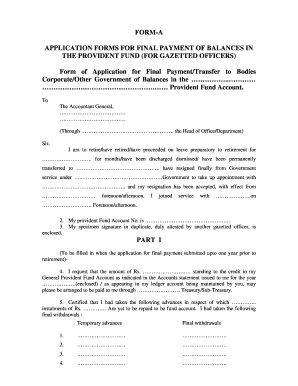

This letter may be written by those employees who have been a part of a certain company, and after resignation they are asking for the full and final settlement of payments or dues which have to be settled by the company. Format is given below. Your employer must pay you everything you’re owed in your last pay packet, even if you’ve been dismissed.

If you owe them money they might be able to take it from your pay.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.