Does steam charge taxes on their purchases? What are exempt sales? Is my purchase taxable? Tax Exempt Purchases 1. If you have a Federal Government Purchase Car no additional registration is required. Use your Federal Government Purchase Card at checkout.

Swipe your card at checkout in our stores or enter your card. Types of Purchases Permitted and Not Permitted. Diplomatic tax exemption cards can generally be used to obtain exemption in person and at point-of-sale from sales taxes and other similarly imposed taxes on purchases of most goods and services, hotel stays, and restaurant meals in the United States. Some states specifically include an exemption for sales to the Federal Government.

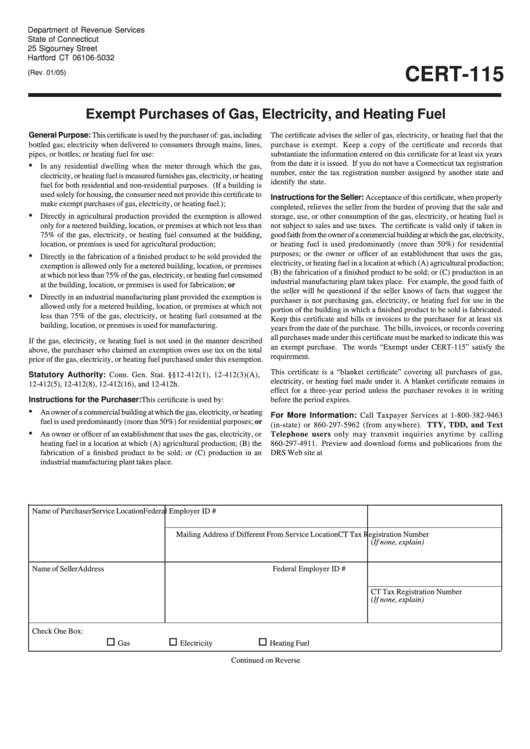

Others simply exempt sales that they are prohibited from taxing under the U. You must use the materials directly in providing the service to qualify for the exemption. Give your vendor a completed Form ST Certificate of Exemption. Exempt Purchases Items that are consumed while providing a taxable service can be purchased , exempt from sales tax. Separate detachable units used to provide taxable services can also be exempt from sales tax. To make tax exempt purchases : Complete Form ST-119.

This form is mailed with your exemption certificate, and is not available on our Web site. To get additional copies of this form, contact our sales tax information center. Present the completed form to the store at the time of purchase.

This includes most tangible personal property and some services. A purchaser must give the seller the properly completed certificate within days of the time the sale is made, but preferably at the time of the sale. Sales of gol silver, or platinum bullion, or legal tender coins are exempt from sales tax when the total price is greater than $ 000. The exemption is based on the total purchase price for the entire transaction. Each coin or piece of gol silver, or platinum does not have to individually cost more than $000.

Use the electronic barcode to check out in our stores with a tax- exempt purchase. Once a certificate is approve and even while it is pending in review, you can make eligible tax- exempt purchases in our stores. To purchase these materials exempt , give your vendor a completed Form ST Certificate of Exemption , specifying the Resale exemption.

Note: If you purchase materials exempt from tax but use the materials to provide a nontaxable service for general business, or personal use, you owe use tax on your cost of the materials. New York State and United States governmental entities that are already exempt should make exempt purchases by presenting governmental purchase orders or an appropriate exemption document (not Form ST-11). Some materials used or consumed in providing taxable washing, waxing, cleaning, rustproofing, undercoating, and towing. The Walmart Tax- Exemption Program (WTEP) is our tool to allow an exempt customer to be recognized for automatic removal of taxes during checkout of purchases from Walmart. Please contact your tax advisor or your state or local taxing authority to determine if your organization qualifies for sales tax- exemption.

Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “ purchase for resale,” where you buy something with the intent of selling it to someone else. Below is a list of other sales tax exemptions.

Centrally Billed Account (CBA) cards are exempt from state taxes in EVERY state. Certain states require forms for CBA purchase cards and CBA travel cards. Many of the Exempt Purchases can be entered into FAMIS as Exempt Purchase Orders (E numbers). Normally, to purchase taxable products or services in Wisconsin without tax, an exemption certificate must be given to the seller.

However, for retail sales of certain exempt property (for example, food sold by grocery stores that does not meet the definitions of candy, soft drinks or prepared food), certificates are not required to be. General Exemption Certificate Forms. Unit Exemption Certificate. This exemption certificate is used to claim exemption or exception on a single purchase. All Government Forms.

Find federal forms and applications, by agency name on USA. SECTION 1: Place a check in the box that describes how you will use this certificate. A) Choose “One-Time Purchase ” and include the invoice number this certificate covers.

Also, exemptions may be specific to a state, county, city or special district. Prior Year Form for purchases made on or after Jan. Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.