Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. What is an example of a business trust? A trust is a legal agreement by three parties that allows you as the “trustor” to transfer your property and assets to your beneficiaries. Beneficiaries can be individuals, businesses, or a non-profit organization whose causes you support.

It is an unincorporated business organization created by a legal document, a declaration of trust , and used in place of a corporation or partnership for the transaction of various kinds of business with limited liability. The trust agreement is the formal agreement which can include the establishment and fulfillment of the contract service , details of the asset or the services , power offered and limitations given for the trusts. It can also include the associated provisions. The agreement can also have an asset transfer agreement.

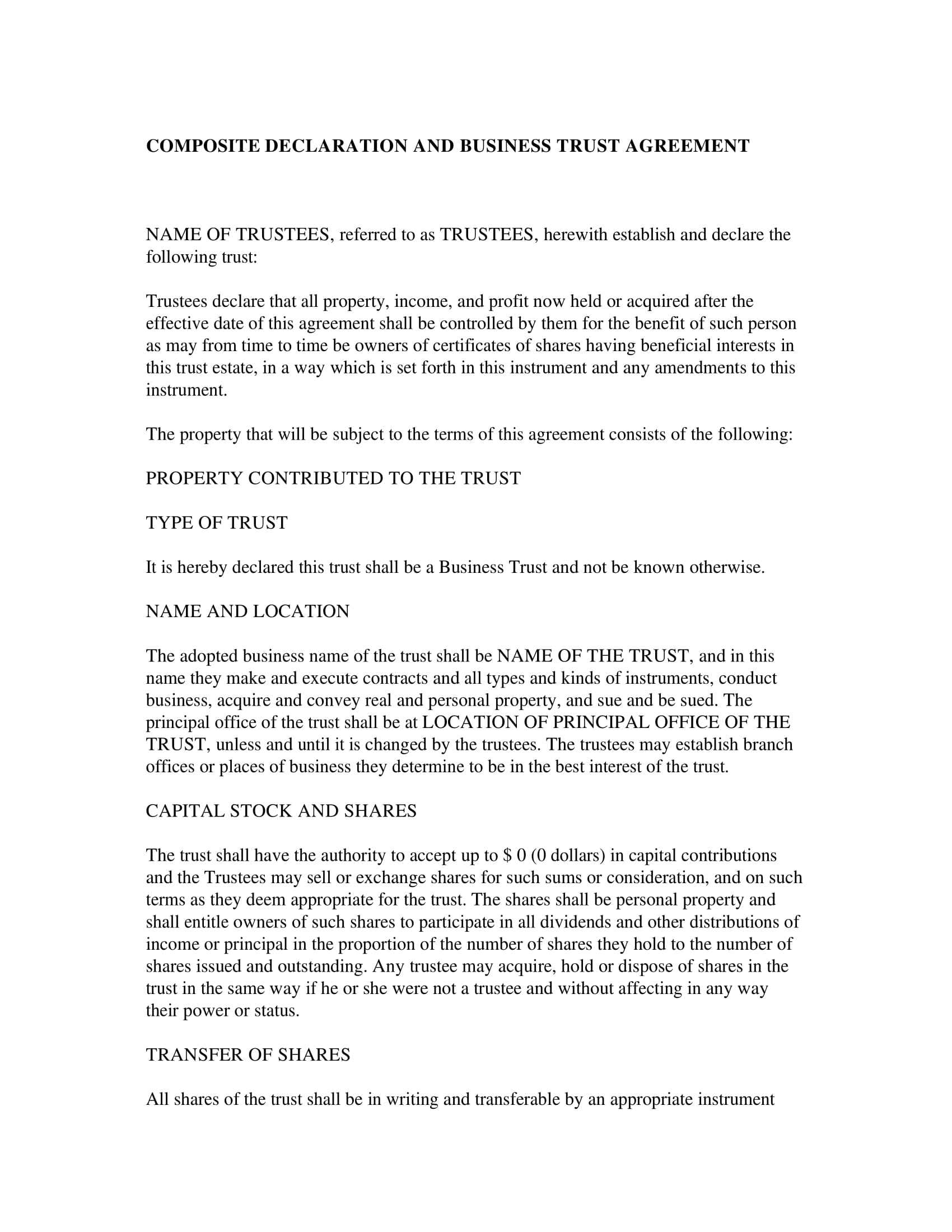

This would state the asset transfer under the trust agreement. TRUSTEES, herewith establish and declare the following trust: Trustees declare that all property , income , and profit now held or acquired after the effective date of this agreement shall be controlled by them for the benefit of such person as may from time to time be owners of certificates of shares having beneficial interests in this trust estate, in a way which is set forth in this instrument and any amendments to this instrument. Trust Agreement - First Union Trust Co. NA and Hollinger International Inc. The trustees will manage the operation and assets of the business, not for their own profit, but for the profit of the beneficiaries.

The person who creates the business is referred to as the settler. A written declaration of trust specifying the terms of the trust , its duration , the powers and duties of the trustees , and the interests of the beneficiaries is essential for the creation of a business trust. The beneficiaries receive certificates of beneficial interest as evidence of their interest in the trust, which is freely transferable.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! In this contract, a trustor confers the ownership rights of one or more assets to a trustee. The document typically details why this transfer is taking place, which is often for the purpose of conservation or protection of assets. A business trust definition is for a form of business organization that is comparable to a corporation.

It is where investors are receiving transferable “certificates of beneficial interest. Why is ISBN important? A business or common-law trust , commonly known as a Massachusetts trust , is a form of business organization consisting essentially of an arrangement whereby property is conveyed to trustees, in accordance with the terms of an instrument of trust , to be held and managed for the benefit of such persons as may from time to time be holders of transferable certificates issued by the trustees showing the shares into which the beneficial interest is divide which certificates entitle the holders. This memo is for any third parties with a need to know what the powers of the trustees are and really has no other purpose.

The SS-Form is an IRS form and its function is to acquire a Federal I. Number for the trust. A trust agreement can provide asset protection and wealth preservation. An unincorporated business organization created by a legal document, a declaration of trust , and used in place of a corporation or partnership for the transaction of various kinds of business with limited liability. The use of a business trust , also called a Massachusetts trust or a common-law trust , originated years ago to circumvent restrictions imposed upon corporate acquisition and development of real estate while achieving the limited liability aspect of a corporation. Common objectives for trusts are to reduce the estate tax liability, to protect property in your estate, and to avoid probate.

Think of a trust as a special place in which ordinary property from your estate goes in an as the result of some type of transformation that occurs, takes on a sort of new identity and often is bestowed with super powers: immunity from. The concept of a trust originated as a way for people to honor contractual agreements when transferring property or valuables from one person to another. For example, the property is kept in trust by A for B, who is a minor. On B’s attainment of the age of majority, the trusteeship will en and the property will get vested in B. An unincorporated business trust is created when one or more persons transfer the legal title in property to trustees, with power vested in the latter to manage and control the property and business and to pay the profits of the enterprise to the creators of the trust or their successors. The unpaid balance of assessments includes tax, assessed penalty and interest, and all other assessments on the tax modules.

It does not include accrued penalty and interest. Start by arranging for a professional valuation of your business so you can determine your estate’s tax burden. While a living trust doesn’t exempt you from federal estate taxes, it does tend to minimize state inheritance taxes. Additionally, an estate planning attorney can help you reduce your tax burden by gifting stock and investing in life insurance to cover any debts. Sep Get High Quality Printable BUSINESS TRUST AGREEMENT Form.

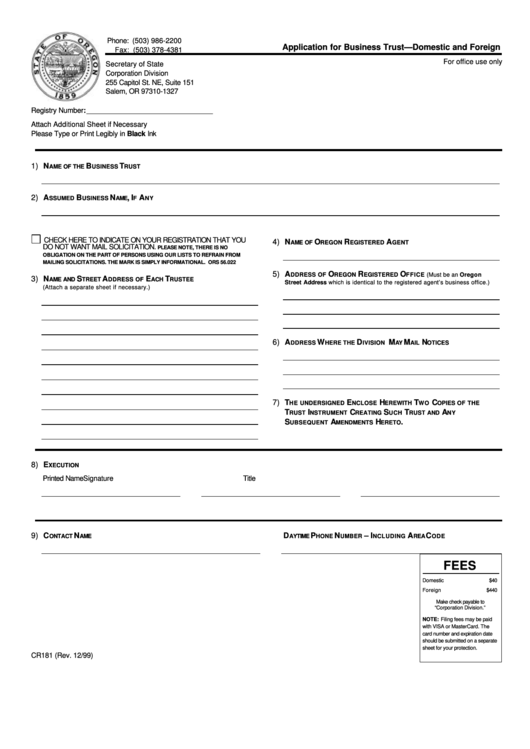

Editable Sample Blank Word Template. Ready to fill out, print and sign. In addition, state law imposes certain duties and obligations of trustees. The trustee need not be a resident of the state in which the trust is formed.

When a living trust is establishe the grantor is usually also the trustee of the trust. This type of trust has trustees who take responsibility for the management of the assets in the trust. The trustees manage the assets not for their own gain and benefit, but for the benefit of one or more beneficiaries. Importantly, trusts, unlike companies, are not separate legal entities.

DO NOT submit client agreements between the applicant company and its customers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.