The Tax Cuts and Jobs Act that went into effect on Jan. Knowing your income tax rate can help you calculate your tax. Find advice on filing taxes, state tax rates, tax brackets. FREE payroll deductions calculator.

Returns claiming the earned income tax credit, or EITC,. Your bracket depends on your taxable income and filing status. These are the rates for taxes due. Are there tax brackets?

Do they apply to everyone? Technically, they do. Can the wealthy get around them? I had stumbled across a discussion on Twitter of what top tax rates might be reasonable. How are the income tax brackets calculated?

How do you calculate federal income tax? What is the tax bracket? View federal tax rate schedules and get resources to learn more about how tax brackets work.

The federal government uses a. The income brackets , though, are adjusted slightly for inflation. A Tax Agent Will Answer in Minutes! Questions Answered Every Seconds.

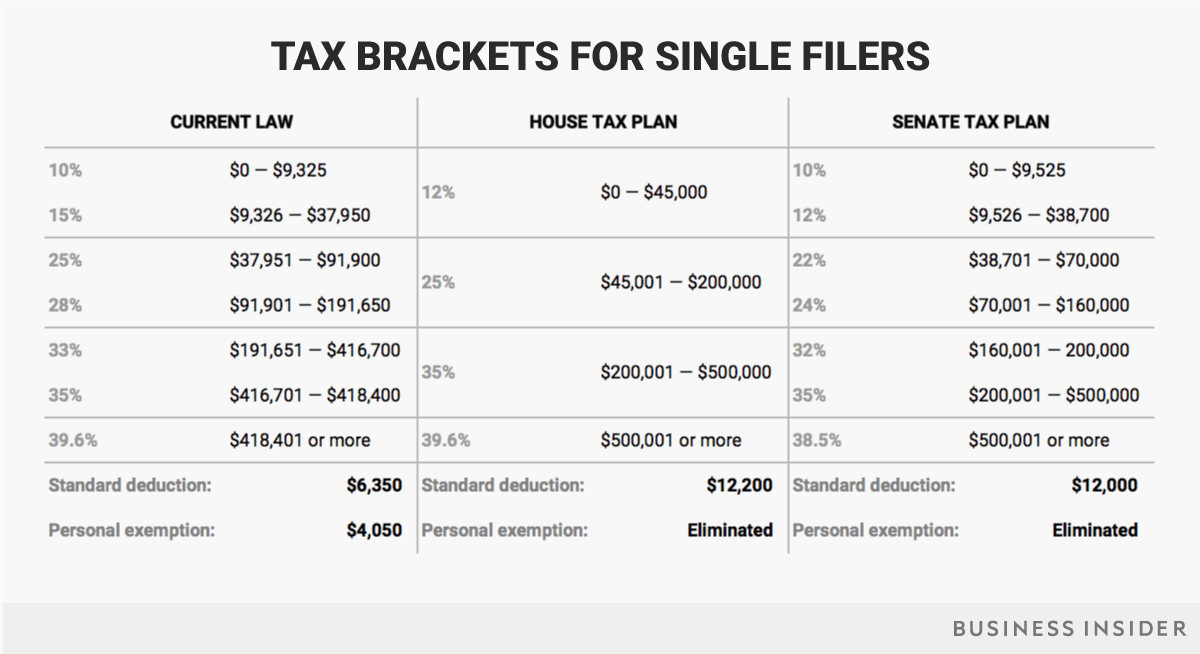

However, most taxpayers—all except those. Based on your annual taxable income and filing status, your tax bracket determines your federal tax rate. In a progressive individual or corporate income tax system, rates rise as income increases. Use this tax bracket calculator to discover which bracket you fall in. Being in a “higher tax bracket ” doesn’t mean all of your income is taxed at that rate.

We keep our database updated with the latest tax brackets each year, and aim to be the easiest and most comprehensive income tax resource available on the Internet! TurboTax will apply these rates as you complete your tax return. Most taxpayers pay a maximum rate, but a tax rate applies if your taxable income exceeds the.

Remember that the tax rates are marginal. You’ll also be able to look back at last year’s brackets to see how the numbers have changed. The associated state tax rates or brackets vary by state.

Congress sets the rates and income that falls into them when a tax law is created or changed. Then the Internal Revenue Service adjusts the income brackets each year, usually in late October or early November, based on inflation. The taxes we pay depend on two things.

Under state law, Minnesota’s income tax brackets are recalculated each year based on the rate of inflation. The indexed brackets are adjusted by the inflation factor and the are rounded to the nearest $10. Income tax rates are also set by the law.

See Minnesota Statute 290. It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the. Your employer may have already adjusted your withholding to account for the new tax brackets , so if your income remains the same then your take-home pay should be slightly higher.

The bottom line is that all the tax bracket upper limits went up a little bit. Try the Free Tax Brackets Calculator. Knowing which tax bracket you are in can help you make better financial decisions.

The top marginal income tax rate of percent will hit taxpayers with taxable income of $514and higher for single filers and $620and higher for married couples filing jointly. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (, , , , , or ). We shop and deliver, and you enjoy. Access IRS Tax Forms.

Complete, Edit or Print Tax Forms Instantly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.