For the extra coverage you need. Enroll for the added benefits. Receive a Customized Free Quote. Get a Free Quote Today! Speak With A Licensed Insurance Agent Today!

Part B covers types of services. Helps paying out-of-pocket costs. The amount can vary depending on your situation. Standard monthly premiums will cost $1. TO FREQUENTLY ASKED QUESTIONS.

The reimbursements will be issued in April. So most beneficiaries are paying the standard $144. Manage Your Care Cost Effectively By Understanding Your Plan B Options. Alternative to Original Medicare. But if their income is $170or more, they’ll each pay an.

In the grand scheme, when a couple on Medicare have over $174k in income, they are probably already paying a large amount in taxes. It is separate from the health insurance premiums you will pay if you choose Medigap , Medicare Advantage ( Part C) or Prescription Drug Coverage ( Part D). Medicare B — This is supplemental insurance, and you can include it. Doctors Accepting Medicare. You can deduct medical.

Also known as Medigap Insurance. Most people will pay this amount. A small number of people pay a premium that is lower than the base premium. These people are protected by the hold harmless rule.

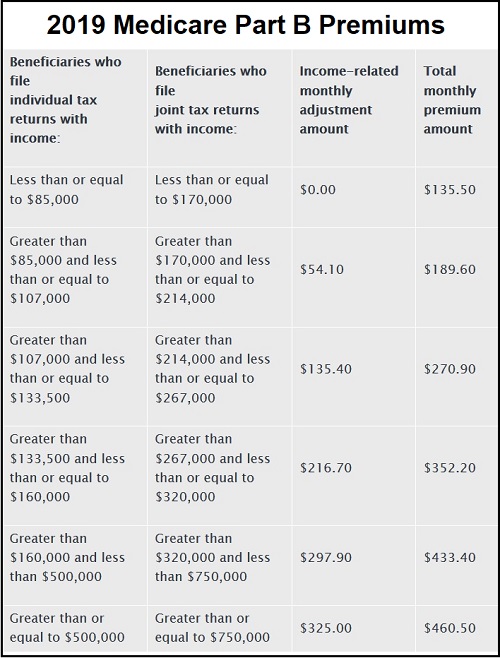

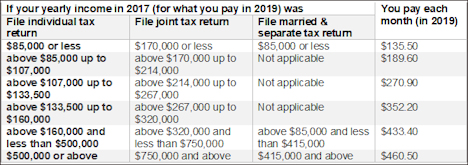

Medicare Part D — This is voluntary insurance and it’s always includable. But about million high-income retirees will pay additional monthly surcharges ranging from $54. Set by the Centers for Medicaid and Medicare Services (CMS). After staying the same last year, Medicare ? The premium will increase $1. More than $100but less than or equal to $13000.

An individual can be eligible for QMB only or QMB and Medicaid. Insurance premiums are among the many items that qualify for the medical expense deduction. There are also deductibles and coinsurance. That’s a nearly 7- increase if you’re paying the standard premium. As always, if your income decreases, your premium may be reduced.

A Part C plan combines other parts of Medicare (Original Medicare an usually, Part D) and can provide you with a broader range of benefits. Social Security benefits will pay less ($1on ). If your modified adjusted gross income as reported on your IRS tax return from years ago is above a certain amount, you’ll pay the standard premium and an Income Related Monthly Adjustment Amount (IRMAA). After the deductible has been pai Medicare pays. As for the Part A premium , CMS will raise it from $4per month to $4per month next year. Then you pay $3a day for days through 90.

Earlier this year, the Medicare Trustees Report projected that it would be about $153.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.