What is the penalty for registering late under GST? The effective date is something you can discuss with the CRA agent when you call. See full list on iras. If at any time, you can reasonably expect your taxable turnover in the next months to be more than S$million. You must have supporting documents to support your forecast value of $1million.

Signed contracts or agreements 2. Accepted quotations or confirmed purchase orders from customers 3. For example, you made a forecast based on market assessment, business plans or sales targets. Invoices to customers with fixed monthly fee charged 4. Your taxable turnover is wholly or mainly from zero-rated supplies and you can choose to apply for exemption from registration. You will not be required to register for GST if: a. The taxable turnover is projected to be lower due to specific circumstances(e.g. large-scale downsizing of business) 3. You may also be liable for registration: 1. GST-registere or 2. Singapore that are not registered for GST. For more information on the requirement to register for GST under these regimes, please refer to GST on Imported Services.

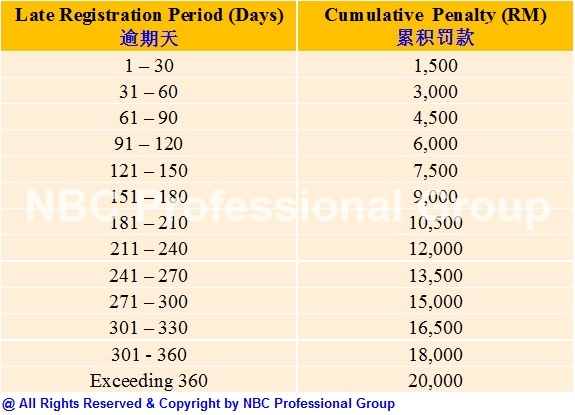

IllustrationThere are serious consequences for late registration : 1. Your date of registration will be backdated to the date that you were liable to be registered. Prosecution action may ap. How do I register with GST ? Lodge your Grievance using self-service Help Desk Portal. The late fee is also applicable for the delay in filing Nil returns. Late fees and interest rates form the important components of GST payment and are generally incurred by businesses as well as taxable individuals if there is a delay, whether intentionally or unintentionally, in submitting or filing their GST returns for the given due date.

Most Canadian businesses must register to collect consumption tax in the form of the goods and services tax ( GST ) and harmonized sales tax (HST). Sellers collect these taxes from customers at the time of sale and then file and pay them to the Canada Revenue Agency (CRA) at intervals determined by. The amount of late fee payable depends on the type of return to file no of days of delay and due date for filing such return. As per GST law, the total amount of late fees applicable for Annual Return form GSTR cannot exceed 0. Interest: Along with the late fees, a non-compliant taxpayer is also liable to pay interest under the following conditions.

GST Registration online application. Get GST Certificate in just days. Important Note: In GST Council meeting held on 22nd December it has been decided to bring one-time late fee waiver scheme. Choosing how you will report on your GST when you register for GST.

Registering for GST voluntarily You can choose to register for GST if your turnover from a taxable activity is. Under GST , single registration is required for different taxes. Also, if your business has multiple branches in different states, you are required to register separately for each state. A person is registered under GST.

You are not a small supplier. Did he is required to need a separate registration for deduction TDS under Section or collecting TCS under Section 52? Goods and Services taxes ( GST ) returns for the COVID -19. Is a late payment penalty subject to GST ? ITCs can be claimed on such expenses only if a registrant can successfully backdate its effective date of registration.

GST registration is necessary for every taxpayer who falls under GST criteria.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.