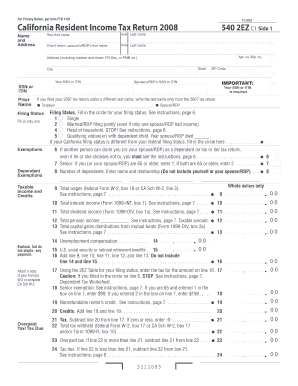

Exemptions For line line line and line 10: Multiply the number you enter in the box by the pre-printed dollar amount for that line. This form will be used for tax filing purposes by citizens living and working in the state of California. This form is used each year to file taxes and determine if the filer owes taxes or is entitled to a tax refund. Do I have to file a 5tax form?

Check here if this is an AMENDED return. Confirm only California income tax withheld is claimed. Register and subscribe day free trial to work on your state specific tax forms online. It covers the most common credits and is also the most used tax form for California residents.

Using both and are acceptable. Part-time or nonresident filers must instead file form 540NR. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar-for-dollar reduction of tax liability.

Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. TurboTax Online will automatically generate this form for you. You have 0-dependents. Forms 5and 540NR (to be added) are Forms used for the Tax Return and Tax Amendment.

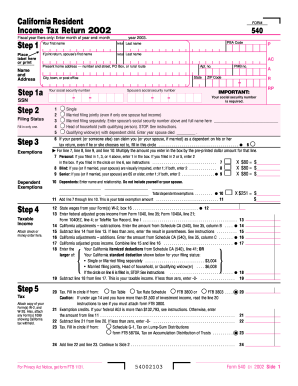

If there is none, enter (zero) or check one of the line checkboxes to indicate no use tax is owed or the use tax obligation was paid directly to the CDTFA. Louisiana residents file their state income taxes using a form IT- 540. This document can be obtained from the website of the Louisiana Department of Revenue. Louisiana Resident Income Tax Return It- 5Step 1: At the top of the first page, give your name and Social Security number, as well as that of your spouse if filing jointly. Form 5, line 7 matches amounts from your W-2’s.

Also, learn how to reduce taxes on your 5form , review tax software and find a CPA or tax preparer. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! Citizens of the state with moderate incomes and few deductions can save time by using this form.

The EZ tax returns are only two pages long, and can be printed as a hard copy on one double-sided piece of paper. Federal column on Form IT-540B, Line 7. Line - AMTI Exclusion Qualified taxpayers must exclude income from any trade or business when figuring AMTI. Have not seen any information as to when Turbotax will update California FTB, even though form 5is available otherwise.

Over-rides are not permitted it seems. Form IT- 5is the long individual income tax return for Louisiana taxpayers. See instructions, page 1 and Refundable Child Care Credit Worksheet, page 17. Attachment Sequence No. If you are a nonresident, choose Form IT-540B.

Your social security number. Medical and Dental Expenses. Caution: Do not include expenses reimbursed or paid by others. California Income Tax Return Form requires calculations of various heads and instructions for the same are available next to each step requiring calculation. Supported state tax forms.

Review state tax filing information and supported state tax forms. Prepare and e-file taxes for free when you qualify. Ordering forms and publications.

Year 5was a leap year starting on Sunday (link will display the full calendar) of the Julian calendar.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.