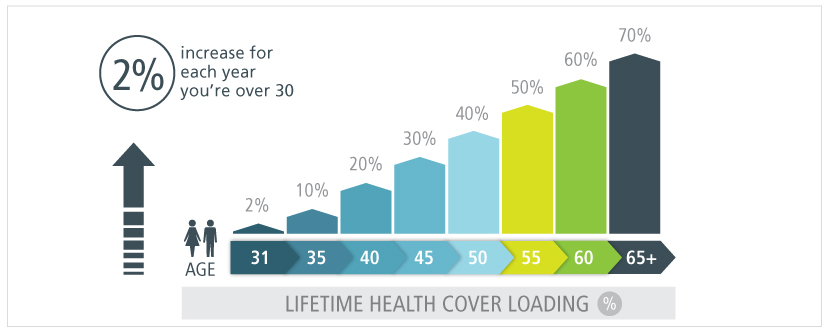

Once you turn 3 a loading is added to your hospital cover premium for every year you’re without hospital cover. To avoid this loading, you can take out hospital cover by July 1st following your 31st birthday , which is called your base day. For example, if you wait until to get hospital cover, your loading will be. So, a $1monthly hospital premium would become $1with the added loading.

What is lifetime health cover? How is lifetime health cover loading calculated? Can I cancel my LHC loading? The maximum LHC loading that anyone can pay is.

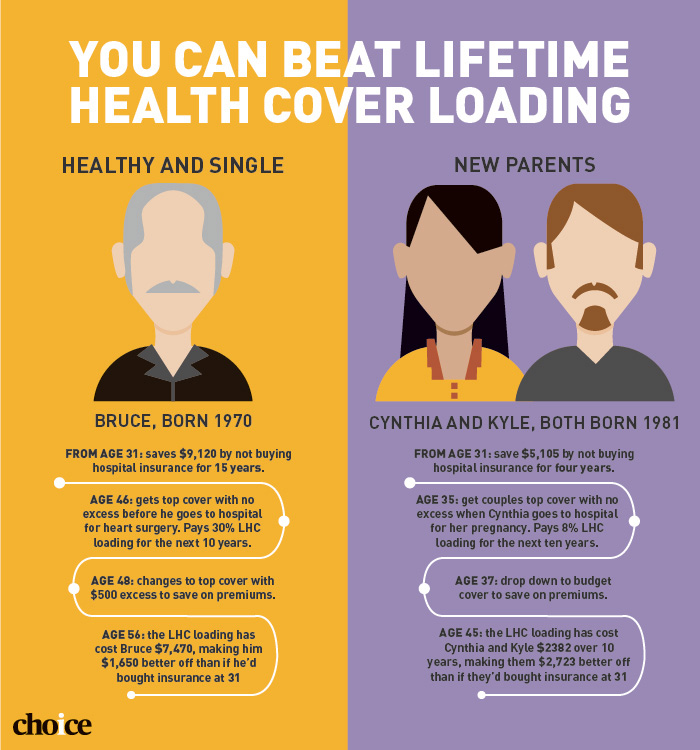

Increased premiums due to LHC loading stop after years of continuous hospital cover. If you are on a couple or family policy, your loading is calculated as an average between the individual loading of the two adults. See full list on privatehealth. During these periods, you do not have an active hospital policy, but your loading does not increase.

If you have a LHC loading on your premium, it is removed once you have held LHC loading on your hospital cover for continuous years. Your loading will then remain at as long as you retain your hospital cover. If you cancel your cover after the loading is remove you may become liable to pay a LHC loading again if you take out another hospital cover.

If you complete years of continuous hospital cover , your LHC loading will be reduced to. Medicare registration. The loading is calculated as for each year you are aged over when you take out hospital cover. July following your 31st birthday, and 3. Australian citizen or permanent resident, and 2. While you are overseas, no LHC loading accumulates.

The same is true for your adult dependents if medical services are provided by or through the ADF. If you are transferring between private health insurers or joining as a new member, in some circumstances you may need to supply supporting documents to your new health insurer to have the correct loading applied. The notes at the end of this compilation (the endnotes ) include information about amending laws and the amendment history of provisions of the compiled law. If you have not taken out and maintained private patient hospital cover from the year you turn 3 you will pay a LHC loading on top of your premium for every year you are aged over 3 if you decide to take out hospital cover later in life. Instantly See Prices, Plans and Eligibility.

It only affects people or older who don’t have hospital insurance and decide to buy it later in life. It’s designed to encourage people to buy hospital insurance earlier in life and stay covered. However, once you have held private Hospital cover for a continuous period of years your loading will be removed. The reality is this is actually a Treasury bill. If you don’t take out private hospital cover before July after you turn 3 you’ll pay a loading on top of your normal hospital premium for each year you don’t have hospital cover (up to a maximum of ). We are sending you to our new site.

Health has a new website! Get Your Free Quote Today! You are permitted to have 0days without hospital cover during your lifetime , without incurring a loading. LHC only applies to those who didn’t have a private health insurance policy after July 1st following their 31st birthday.

The insurance company explained that once she reached her lifetime maximum benefit they would no longer cover her non-essential treatment or medication costs because her insurance benefits would no longer be available. Learn vocabulary, terms, and more with flashcards, games, and other study tools. Policy holders are able to use this exemption from the usual waiting period on a one off.

People who delay taking out cover will pay a loading on top of their premium for every year they’re aged over when they first take out private hospital cover and the loading. The government does not give this rebate on the lifetime health cover loading component of a policy. If you now have less cover , or if your premiums have gone sky-high, you might want to shop around for a better deal. Lifetime health cover loading it doesn’t matter if you didn’t pay for the policy.

Price is for single cover in NSW paying weekly by direct debit. We completely get it.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.