Every trader wants to expand their business by extending the trades, not just countrywide but also globally. Indee to help these traders grow their exports and enhance the functionality of their business, the government has made several provisions. One of the major ones is the GST , i. Adding to this, an arrangement of Letter of Undertaking has also been made allowing the exporters to export goods without paying IGST (Integrated Goods and Services Tax). See full list on vakilsearch. LUT means Letter of Undertaking.

Paying the Integrated Goods and Services Tax (IGST) and then claiming for the refund amount. Filling the Letter of Undertaking (LUT) or bonds, and being exempted from paying taxes (IGST) for exports. All the people who have registered themselves under the GST act can submit the LUT.

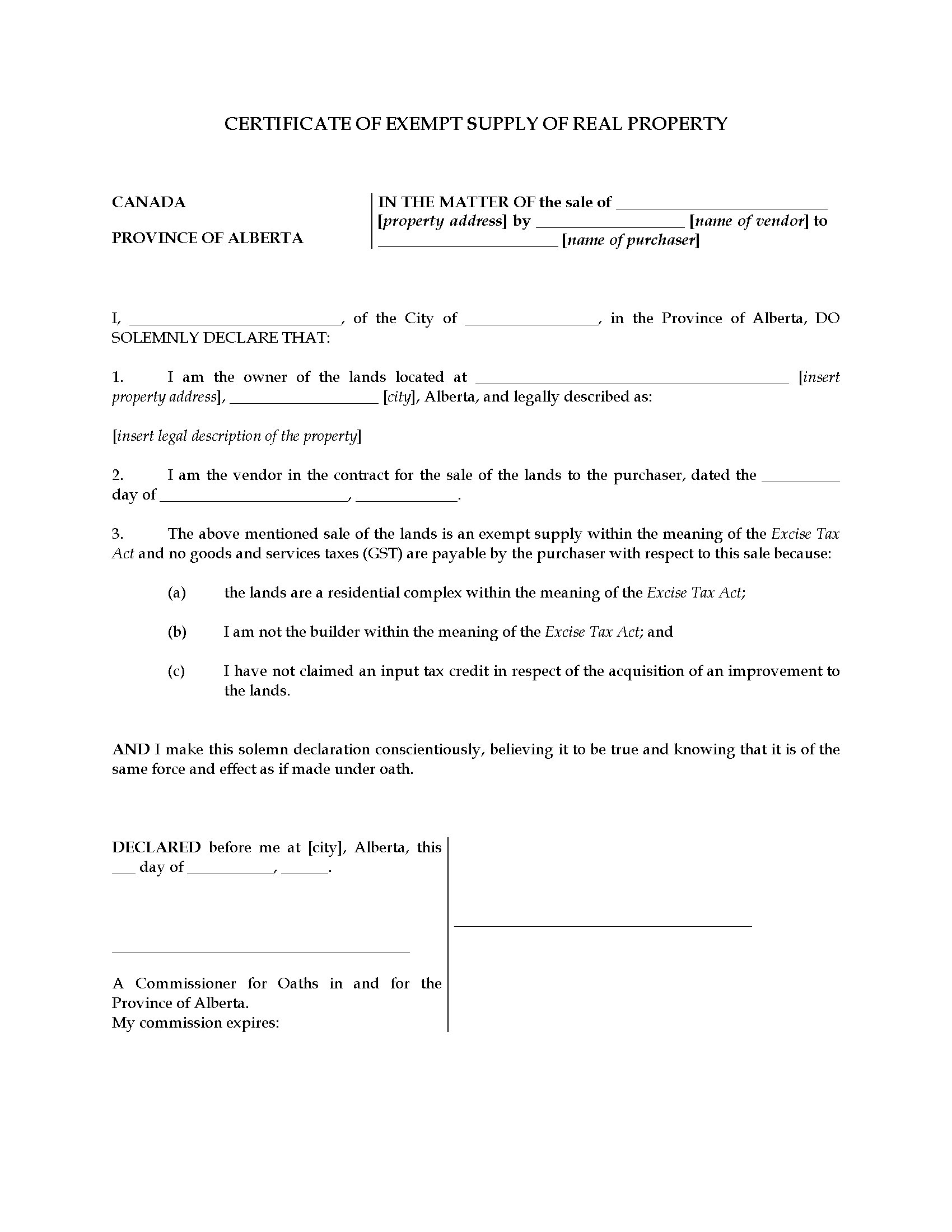

The only exception stands for those who have been summoned for tax evasion. GSTIN (Goods and Services Tax Identification Number) 2. Under this, the amount exceeds Rs. Name registered under GST 3. Signature and designation 7. Bank guarantee The LUT is valid for one year from the time it is furnished. Once the validity date expires, the form needs to be furnished again by the individual. It can be done instantly online at the GST portal.

The list of the documents to be submitted along with the LUT includes the following: 1. Acceptance cover letter of LUT. A copy of the GST certificate of registration. Notarized original Annexure of LUT (two sets). Form GST RFD 11: Two sets of the original form. Along with these, two witnesses have to be present.

Get the verification of the digital signatures done from the Bank Manager. The witnesses have to provide their IDs and PAN cards. All the details provided in the LUT have to be similar to the ID.

The PAN card of the individual has to be provided. A proof for the incorporation of the company has to be provide i. Bond Incorporation certificate. In case of a partnership, the Partnership Deed must be submitted. Self-declaration of eligibility on a letterhead.

A summary of all the invoices for export sales. These invoices have to be verified and certified by the Chartered Accountant. Earlier, all the processes of LUT were done offline.

But, now, the LUT can be provided online comfortably with some simple steps. From the drop-down menu, choose the ‘Furnish Letter of Undertaking’ option. A new page opens up, where all the details, including the registered name, trade name, GSTIN, etc. On the same page, select the financial year. Next, fill in all the details regarding the LUT on the form that appears on the screen.

In case, the LUT has been furnished manually, you can upload the document. Note: As of now, the signature once submitted cannot be edited. As such, all the exporters and traders can run their business without worrying about paying taxes on their exports just by submitting the LUT.

This not helps the traders but also the government. Information about Form 706-GS(T), Generation Skipping Transfer Tax Return for Terminations, including recent updates, related forms and instructions on how to file. Trustees use this form to figure and report the tax due from certain trust terminations that are subject to the generation-skipping transfer ( GST ) tax. What is exemption from GST? How to prevent automatic allocation of GST tax exemption?

Income Tax, Goods and services Tax, GST , Service Tax, Central Excise, Custom, Wealth Tax, Foreign Exchange Management, FEMA, Delhi Value. This ruling is directed only to the taxpayer requesting it. The Internal Revenue Code (IRC) allows a GST tax exemption just as it does with gift and estate taxes. All these taxes share the same exemption: $ 11.

Only the portion of gifts and transfers that exceed the amount of the federal exemption are taxable. You must pay GST on any amount above that limit. The value of the car you purchase does not include the value of any modifications made solely to adapt the car for you to drive or be driven in. You do not need to send this form to us. If your annual taxable turnover exceeds S$million , you will be required to register for GST.

Exemption from GST registration. However, you may qualify for exemption from registration if you meet both of these conditions: The proportion of your zero-rated supplies over total taxable supplies exceeds. In some cases, they may even present a fake exemption card to avoid paying the tax on their purchases.

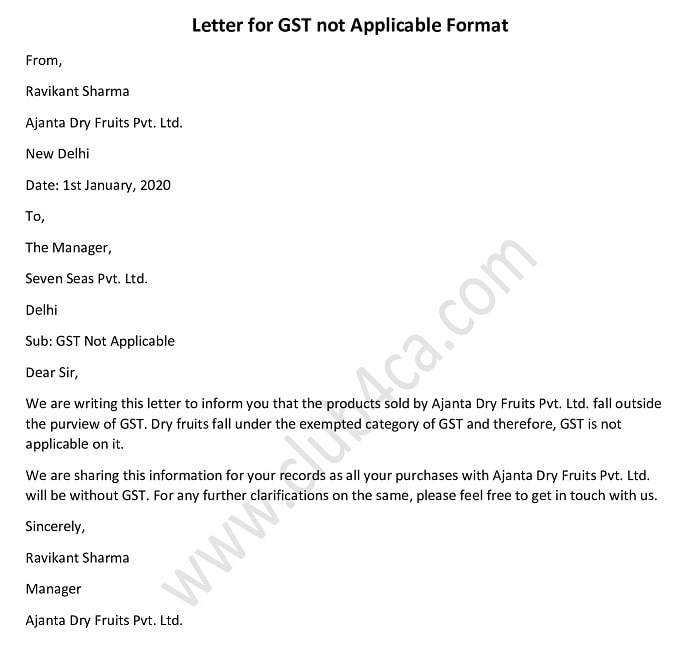

Whereas penal interest charged on the delayed payment of loan repayment will be exempt under GST. There are different options for what and how to report. In a majority of cases, unprocessed goods such as raw silk, etc.

GST exempt however once processe goods such as readymade apparel made from silk are taxable.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.