Register and subscribe day free trial to work on your state specific tax form s online. How to fill out m1pr form? What is Minnesota form M1?

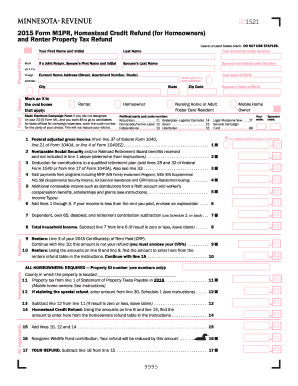

Tired of filling out paper forms ? Homeowners can file electronically for free! The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! Line 16—Original Refund Amount Enter the refund amount from line of your original M1PR return.

If your refund was changed by a previously filed amended return or by the Department of Revenue, enter the adjusted refund amount. From within your TaxAct return (Online or Desktop), click on the Statetab 2. Select Complete all Property Tax Refund QA Once you have completed entering your information, to determine the amount of your Property Tax Refund on your return, click on MN Refund (or Amount Due) in the upper right corner of the screen. Click Property Tax Refund 4. In the tax summary box, select Minnesota Return. The state summary will show the state refund or balance due, and then the Property Tax Refund amount.

To e-file your Minnesota Property Tax Return: 1. Select E-File My Return, and then choose the option to file Minnesota property tax return 3. Continue through the filing steps until you reach the Submit Returnscreen. Your return will not be submitted until you click the Submitbut. If the department receives your properly completed return and all enclosures are correct and complete, you can expect your refund: 1. See full list on taxact. August if you are a renter or mobile home owner and you file by June 1 or within days after you file, whichever is later. September if you are a homeowner and you file by August or within days after you file, whichever is later.

If your return is incomplete or necessary information is not enclose your refund will be delayed or your return will be sent back to you. CRP(s) from your landlord (if a renter). The change affects those that received or paid alimony. Renters can qualify for a single refund.

If you file later, you won’t receive a refund. Instea file directly through the Minnesota Department of Revenue. Reap the benefits of a electronic solution to create, edit and sign contracts in PDF or Word format online. Convert them into templates for numerous use, insert fillable fields to collect recipients? This refund does not transfer to your Minnesota Form M1.

Spouse’s Social Security Number 5. Easily edit, fill in and sign PDF form s and agreements online using the best PDF signer! However, now the candidates. Minnesota residents may apply for a property tax refund by filing a form M1PR. Your browser appears to have cookies disabled. Cookies are required to use this site.

Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Apply for free online. That credit is calculated by completing a Schedule. You can also now declare additional nontaxable income using Form M1PR -AI.

Claim your refund by filing form M1PR. Learn about the Senior Citizen Property Tax Deferral Program.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.