When is jobkeeper payment extended? When does jobkeeper entitlement end? What is the jobkeeper payment rate? Key dates and actions for employers.

For the first two fortnights (March – April, April – April ), we will accept the minimum $5payment for each fortnight has been paid to employers even if it has been paid late, provided it is paid by the end of April. High call volumes may result in long wait times. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions.

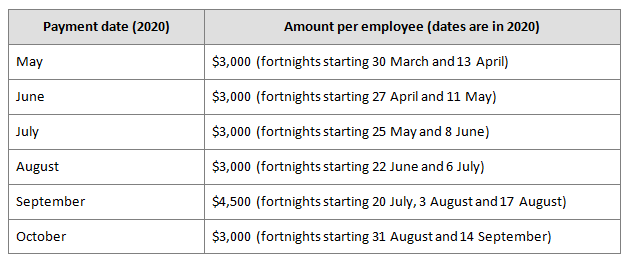

FN and are only paid in June. There are two separate extension periods. The rate will be stepped down in two stages. The ATO has also commenced reviewing the eligibility. Good luck with it all.

As stated below, we generally pay the actual money in arears (a bit like the ATO ) so it would be paid on May for the period ended May ie paid to May. The Ruling is, however, administratively binding on the Commissioner of Taxation. Additionally, the ATO has delayed $billion in payments to more than 70applicants in order to run further checks. The minimum amount must be paid by the employer to each eligible employee in the fortnight.

A xero client was unaware that you had to put a termination date on the jobkeeper employee when they ceased employment and was at the understanding that as they are on STP the ATO would pick up the employee was no longer paid therefore the job keeper payment would cease for that person. This Help article applies to both Reckon Accounts and Reckon Accounts Hosted. JobKeeper subsidy duration. Monday, and the ATO has revealed key dates and new information about alternative eligibility tests.

Go to the Payroll command centre and click Payroll Reporting. I had previously entered the start date as Mar-Apr JOBKEEPER START FNfor this employee. Then today I entered the final date as Mar-Apr JOBKEEPER FINISH FN01.

I then sent the report to the ATO and it was accepted. If a business cannot establish eligibility from that date , they still have opportunities to access the program at a later date should they then satisfy the eligibility criteria. May onwards: identify your employees. Each month: reconfirm number of.

Complete the ATO online forms. Process a pay run and file it with the ATO. Once you’ve set a start date and a payment tier for eligible employees, process a pay run. Payment Deadline APRIL 30. Supporting businesses to retain jobs.

Crucially, for the first two fortnights that run from March to April, and April to April, the ATO will now accept the late payments of the minimum $5per fortnight as long. To find out the full conditions and if this payment is right for you, read who can get it. Read about if you get. Hi, I need help with STP jobkeeper.

I did mistake to put the final date as period 13th and clicked notify ATO. I generated the jobkeeper summary report for Sep, none of staffs were included in period 13. How do i amend the reporting to ATO for jobkeeper payments to get reimbursed for period 13.

However, the Commissioner has indicated there will be some tolerance where employers, in good faith, estimate a decline in turnover but actually experience a slightly smaller.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.