Moreover, on procurement of this certificate , these individuals are required to display the same at their place of business. The opaque structure of a GstSample. A sample contains a typed memory block and the associated timing information.

It is mainly used to exchange buffers with an application. How do I register for GST? When must a business register for GST? But in the case of Casual Taxable person or Non-Resident taxable person, validity is specified to a maximum of days.

Get ready to certify your skills ! The participant will be provided a study material written by renowned author on GST. A certificate will be awarded to the candidate on successful completion of course and after evaluation examination which will be held on last day of the Training. The registration will be on first come first served basis. Click User services 4. Save the certificate 7. If a applicant want to show office on rent and register that place as additional place of Business.

INCOME TAX Articles News Forum Experts Files Notifications. Take a step closer to your dream job and enrich your skills! I have more than one certificate available for download under GSTR-7A certificates.

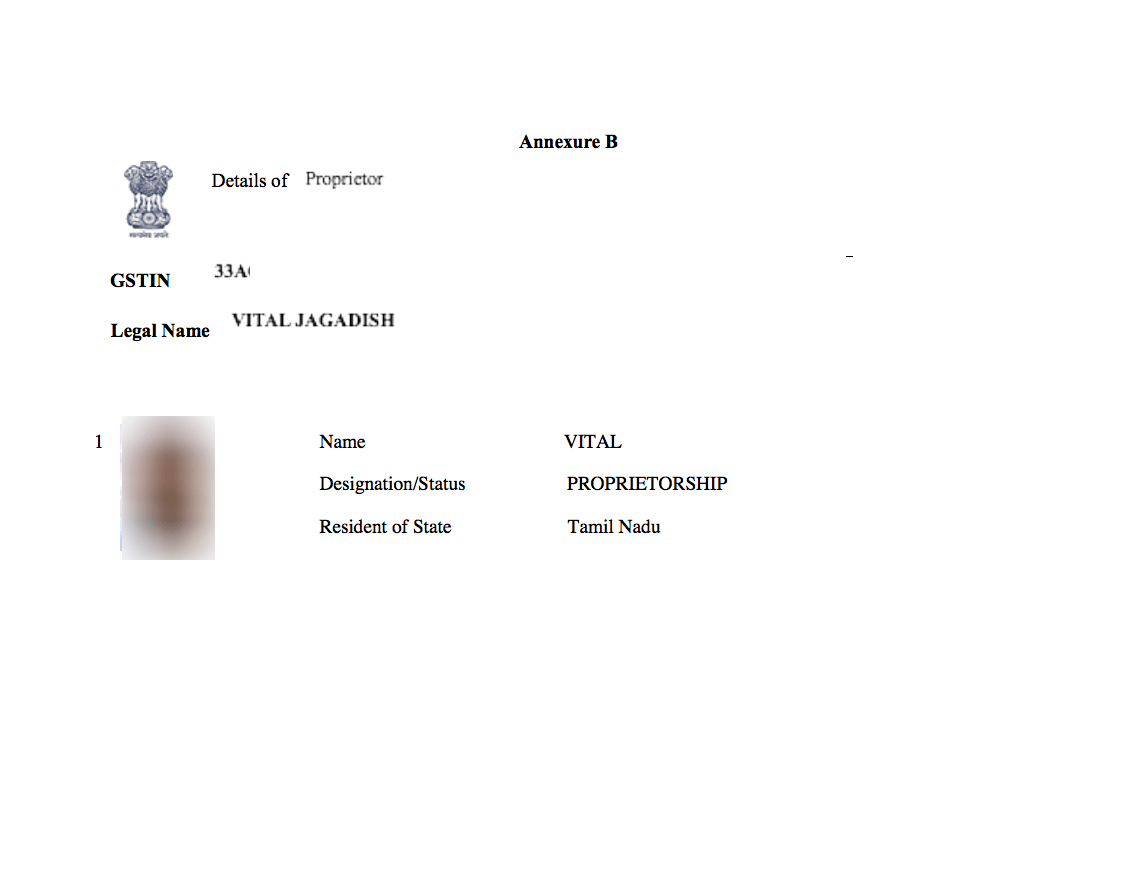

Do I need to download them. Goods and Services Tax Identification Number (GSTIN) is a digit number that is given in a certificate of registration to an applicant. Partner Authorization Letter For GST. Hence it acts as a legal and binding document representing all the terms and conditions of the contract signed between the two parties.

Sub: In response to letter no. There is widespread discontent amongst a large section of the society on this particular aspect. But there are no two views on the fundamental question as to whether India requires GST. The answer, to my min is a clear Yes.

After filling the required details, acknowledgement number gets generated against the online requisition. Format for Minor Purchase above Rs. Trade Name, if any 3. Address of Principal Place of Business 5. Also, composition dealers will have to mention that they are availing the composite scheme and are not entitled to collect taxes from people. Commerce provides you all type of quantitative and competitive aptitude mcq questions with easy and logical explanations.

The tax clearance certificate to be issued under clause (a) of sub- section (8) of section shall be in Form 415. Application for tax clearance certificate. The application for tax clearance certificate under clause (a) of sub-section (8) of section shall be made in Form 414. Certificate of tax clearance. Registration Fee (One time): Rs.

The fees will be paid online. Follow-ups with the associated government department. BTS200_Monthly Remittance of Income Tax Withheld. Have you seen a VA employee doing something noteworthy, in words or action, making a positive difference to the workplace and Veterans we serve.

GST Purchase Ledgers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.