For example, you could designate a primary beneficiary to receive percent of the funds and two secondary beneficiaries who receive percent each. Distributing Property in a Will vs. Through a Beneficiary Designation Understanding the importance of beneficiary designation on bank accounts is a critical part of estate planning. For example, in a beneficiary designation , you can instruct your bank to pay account funds over to a specific person or persons when you die. The bank will provide the new account owner with a few additional forms, and them the money is transferred.

No waiting for probate. The beneficiary of any bank account would be the account holder, I presume. Here in Australia, bank accounts do not have a beneficiary. It may be different in USA. Does beneficiary designation override the terms of a will?

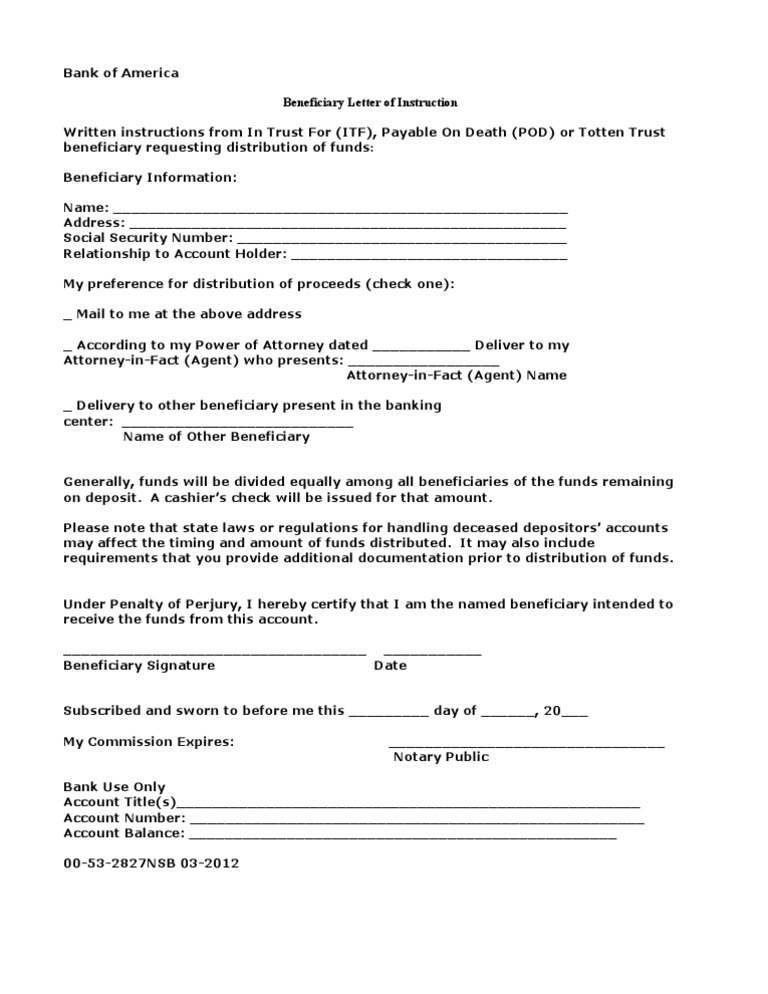

What is bank payable on death form? How can beneficiaries claim payable-on-death assets? What happens to bank accounts at your death? Choosing one or more beneficiaries is as easy as writing a name on the life insurance application.

Request Letter for Change of Company Name in Bank Account This is the template of a covering letter from the company to its banker, wherein the company is requesting the bank to change the name of the company in the records of the bank for the account of the company maintained with that bank. For example , in a beneficiary designation, you can instruct your bank to pay account funds over to a specific person or persons when you die. However, if you divorced years later you probably want to change the designated beneficiary on that account to keep your ex-spouse from getting that money.

Bank account holders are allowed to name many types of entities as beneficiaries , including their estates, individuals, trusts, charities and other organizations. As long as they are alive–a deceased person cannot receive property–you can name them as a beneficiary. You can name your spouse, children, other friends or loved ones. There are, however, a number of potential tax, financial, and legal ramifications if beneficiaries are not named properly.

A beneficiary may be specifie either by name , or by class, such as “children of the insured. EXAMPLE : Mark names his brother as the POD beneficiary of his savings account. Mark does, however, have a will that contains a residuary clause, naming his daughter Madeline as residuary beneficiary. Similarly, you can also divide assets among multiple beneficiaries.

For example , you could designate both your brother and sister as primary beneficiaries of your 401(k) plan and name your favorite nephew and niece as contingent beneficiaries each. Some significant assets, including life insurance policies, IRAs, retirement plans and even bank accounts, allow you to name a beneficiary. When you die, these assets are designed to be paid directly to the individuals you have named as beneficiary.

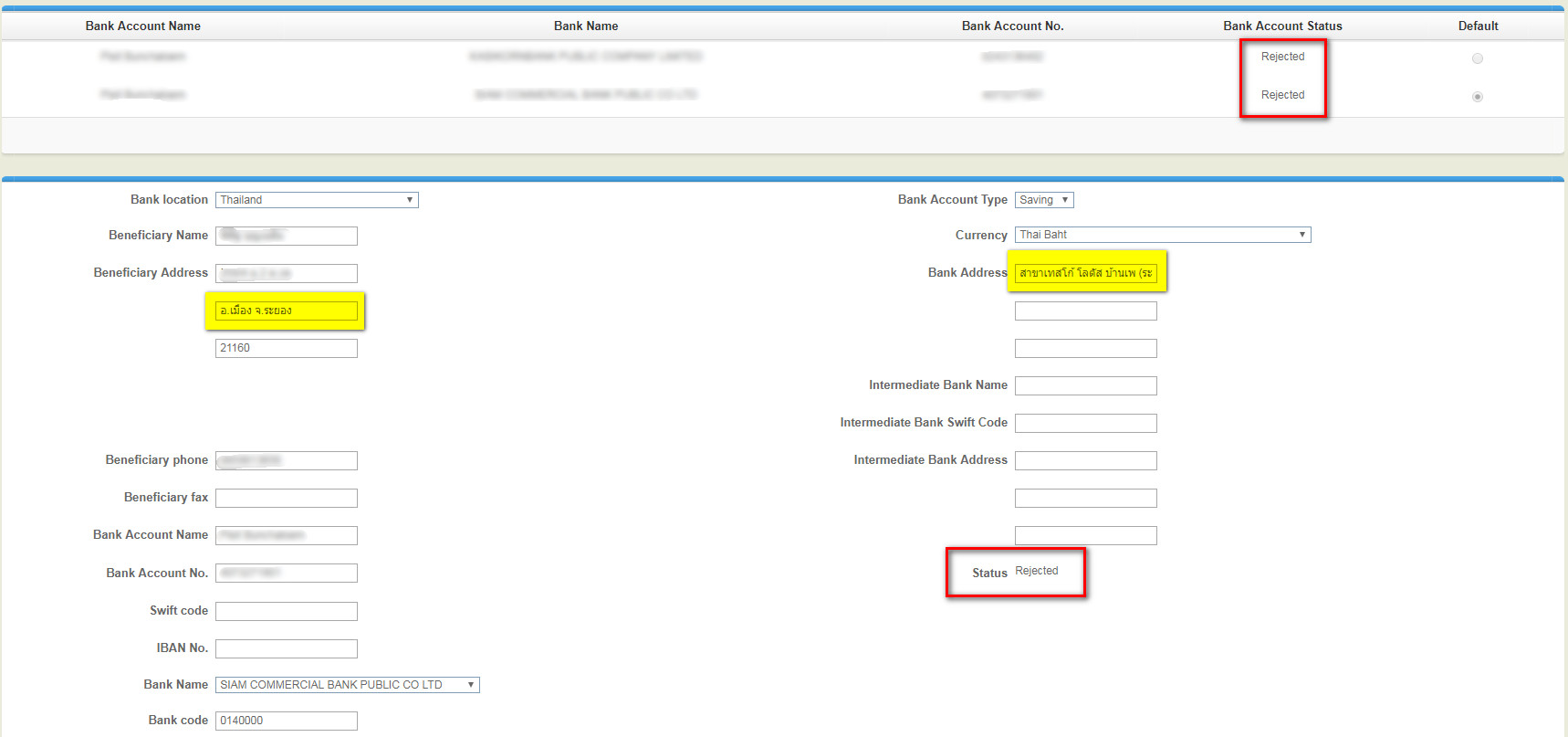

But that is not always what happens. Re-enter the bank account number. Enter the beneficiary name. Give a nickname to the beneficiary. Select the beneficiary ’s bank name from the drop-down menu.

Use the example given below to draft formal and informative letters to beneficiaries as an executor of the trust in a brief and crisp manner. Format for Letter From Executor to Beneficiaries. This same type of beneficiary designation is also available with many brokerage accounts. Contact your brokerage company to establish a beneficiary designation on your personal account.

In a few states, you can have a beneficiary. Please verify that the below information in the Bank Table tab corresponds to the beneficiary bank provided by the beneficiary bank. If you are satisfied with the Order of Precendence you do not need to file any designations. If you do, it’s important to ensure your designations are current.

You may complete different beneficiary forms.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.