Common Stock (AAPL) at Nasdaq. Dividend amounts not split adjusted. MY- APPLE , or find a reseller. See full list on investor.

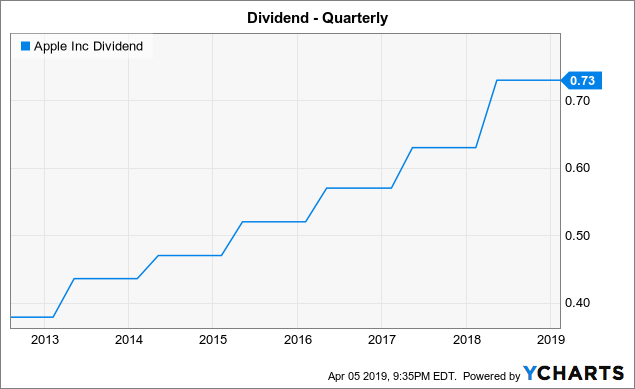

Estimates are provided for securities with at least consecutive payouts , special dividends not included. For ETFs and Mutual Funds, return of capital and capital gains distributions are not included. If the last five payouts show limited variability, we estimate future payouts equal to the most recent one. Apple pays an annual dividend of $ 0. The company has grown its dividend for the last consecutive years and is increasing its dividend by an average of 10.

Now that their stock split is in play, their dividend is $ 0. Due to the stock split, you take their quarterly or annual dividend and divide by 4. At a forward earning project of $3. Apple’s dividend payout ratio is very small, actually, at. Although shares of the tech behemoth have taken a hit in recent days, its continued successes. A cash dividend payment of $0.

But does that mean the stock is a buy? AAPL) stock quote, history, news and other vital information to help you with your stock trading and investing. Commission-free stock trades are here!

Check out what tastyworks has to offer. There are typically dividends per year (excluding specials), and the dividend cover is approximately 3. With a yield of just , investors have plenty of other stocks they can choose to. The dividend is payable on August 1 to shareholders of record as of the close of business on August 10.

Company’s common stock. Data is currently not available The companies in the list above are expected to go ex- dividend this week. Free Investment Report: Get ahead of normal shareholders with these Preferred Stock s. Historical Stock Price Lookup. Going forward Apple’s earnings growth will be driven by several factors.

Therefore, at a dividend yield of 0. Prices shown are actual historical values and are not adjusted for either splits or dividends. AAPL stock should trade at $221. M,3M,6M,1Y price changes 1. Shareholders of record on Monday, August 10th will be paid a dividend of $0. Thursday, August 13th. The ex- dividend date of this dividend is Friday, August 7th.

This represents a $0. Due to the split, the market price per share would go from about $6per share down to about $per share, making the stock affordable for more people. Quote Stock Analysis News Price vs Fair Value Trailing Returns Financials Valuation.

Apple’s stock has performed very well in recent years. Investors of record on Wednesday, March 4th will be given a dividend of $0. A lot of cash — excess cash — would remain in the till.

In my experience, the main criteria to look for when betting on great dividend stocks is a history of.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.