Ready To Get Started? Dependents, Qualifying Child for Child Tax Credit, and Credit for Other Dependents. Wherever You Are In The World. Instructions for Schedule 1. Brown are filing a joint return.

First, they find the. You also have the option of saving your return as a PDF before filing if you want to see how the underlying tax forms have been filled out. High call volumes may result in long wait times. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions.

For most people, it covers all you need to fill in your tax return , but the more technical and less commonly used information is available at ato. Most refunds are issued within business days of lodgment. Tax Return Will Be Filed Right. TENNESSEE DEPARTMENT OF REVENUE.

If you have checked one of the boxes in this section, please see instructions before continuing with this form. Please print neatly in BLOCK LETTERS with a black or blue ballpoint pen only. Income Tax Brackets and Rates. Name of taxpayer claiming Tax Forgiveness (if filing a PA-jointly, enter the name shown first) Social Security Number (shown first) Spouse’s Name (even if filing separately) Spouse’s Social Security Number. Eligibility Questions.

Your Taxes Done With Ease. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. Tax types are listed under multiple categories are the same in both places.

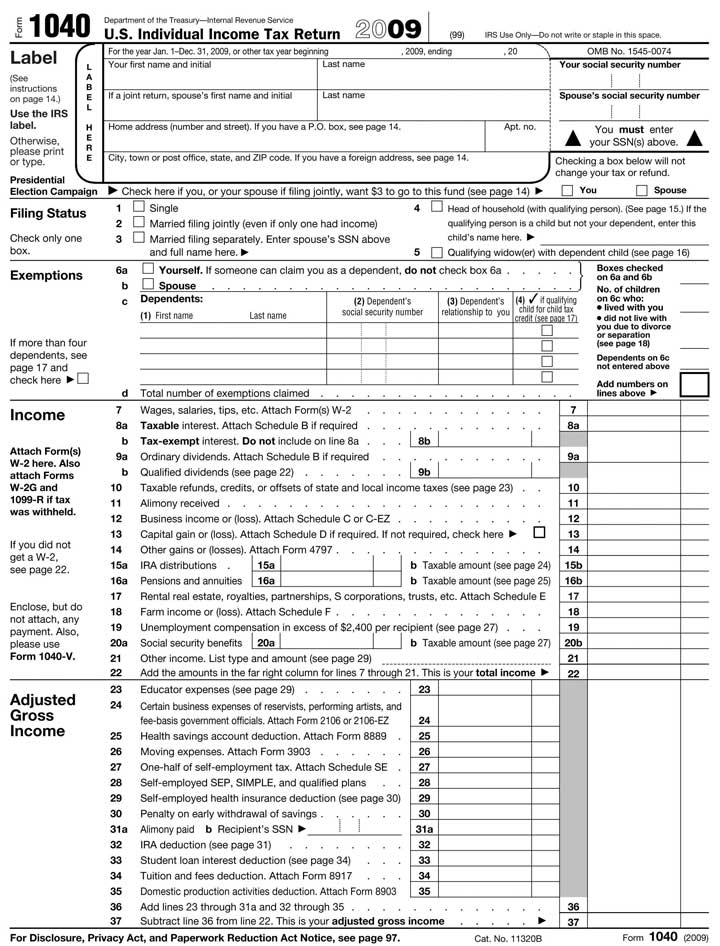

In addition to completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. IRS Use Only—Do not write or staple in this space. Single Married filing jointly. Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS box, enter the name of spouse. Inter-est will be charged from the original due date of the return.

Generally, your Oklahoma income tax return is due April 15th, the same day as your federal return. Line Extension Payment 16. Before preparing your tax return , please review this important information from BNY Mellon’s Pershing. Terms and conditions may vary and are subject to change without notice.

This information is for use by individual U. The PDF will open in a new window, Save the file with the name and location of your choice. Repeat steps and for remaining clients. Click the Setup menu, then Printer Setup. In Printer Settings, check Prompt for Tax. TRD encourages all taxpayers and tax preparers to e-file and e-pay whenever possible.

For individuals being a resident (other than not ordinarily resident) having total income upto Rs. For more details, please refer to the Internal Revenue Circular Letter No. Filing Status Check only one box. Tax Foundation Distributed under Creative Commons CC-BY-NC 4. This form is for use by individuals only.

Businesses, including partnerships and sole proprietorships, must report such purchases on Form ST-or Form ST- whichever is appropriate. PDF Guidance: Some internet browser may have issues with fillable PDF forms. If the due date for filing a return falls on a Saturday, Sunday or legal holiday, the return is due the next business day.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.