Are rent receipts taxable? What is a rent receipt? Can I claim HRA tax exemption by paying rent? How do you get rent receipts?

Rent receipt is an important document which is used as a proof of the rent paid to the landlord. It is a key instrument for tax saving and so should be collected and kept safely. Salaried employees need rent receipts to claim their House Rent Allowance (HRA). In these situations, a rent receipt is a must.

Typically only the portion of the rental you use solely for business qualifies for deductions which would require proof of rent. If of your home is used for business purposes, then of your rent payments are likely to qualify. A rent receipt is provided by the landlord when he receives the rent from the tenant - it has his signature that confirms the receipt of payment. If you are paying rent , you can submit evidence and save tax - total amount is reduced from your gross taxable income.

Rent Receipt for Income Tax For effective and efficient filing of income tax, salaried professionals residing in rented accommodations are required to pay a certain House Rent Allowance or HRA. To be able to file this HRA, one needs to fill up the rent receipts accurately. If you have received the rent receipt, you should keep them with the documents you care about.

Rent receipts can be used for legal matters (in case any) or tax benefits if you are eligible. A rent receipt is an important document which you can use to keep track of rental payments tenants have made to landlords. A rental receipt serves as proof that the tenant gave his due payment to his landlord as part of his obligation in the rental agreement.

If you live in a rented accommodation and you wish to generate a Rent Receipt. To allow you exemption on HRA, it is mandatory for the employer to collect proof of rent payment. Your final tax liability will be calculated accordingly. Your TDS shall be adjusted so you don’t have to pay tax on HRA.

Register and Subscribe now to work with legal documents online. But if you own a home-based business, a rent receipt is a. A professionally made income tax rent receipt that is printable and free. Download this template now and enjoy the high-quality layout and graphic files that you can easily edit and customize. For example, you sign a 10-year lease to rent your property.

A rent receipt provides a proof of payment for tenants so that the landlord could not charge a rent more than one. In addition, tenants can use the rent receipt for tax claims. Tax authorities use the rent receipts to deduct rents as expenses for tenants if applicable.

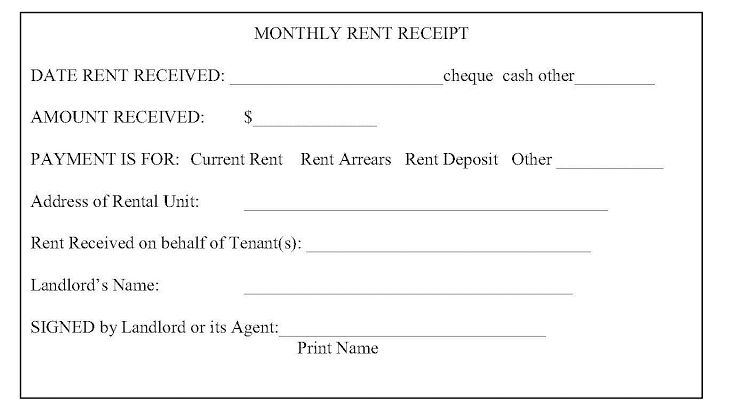

It is an important document to avoid the dispute between the landlord and the tenant. Benefits of rent receipts Rent Receipt Format 1. A rent receipt form is what is issued by the landlord to a tenant that provides information regarding the payments made for renting the landlord’s property. A Rent Receipt is a remittance slip the landlord of a rental property provides for a tenant anytime the tenant makes a rent payment. A Rent Receipt helps the landlord and the tenant keep a record of all the rent payments the tenant has made. This Rent Receipt includes important information, including the amount of the rent payment, the date the payment was receive and the manner in which the payment was made (e.g. cash, check, money order, etc.).

This Receipt also allows the Landlord to detail if the payment was a full or partial payment. Receipts help avoid disputes and act as proof you paid your rent on time. Rent receipts are also important for your taxes, especially if you have a home-based business. Include the date, the amount pai the rental address, what month the payment represents, your name, and unit.

In the days when people paid cash for everyday expenses, business people, like landlords, kept receipt books. When someone paid a bill, the landlord would fill out a receipt. Each page in the receipt book would have a place to write the name of the person paying the money, the name of the person receiving the money, the date and the item paid for. This is usually in the form of cash but can be for credit cards and physical checks as well to show the tenant paid-on-time. Rent Receipts give Tenants evidence that they have submitted payments to the Landlord as required.

They also give Landlords a way to track incoming payments and monitor late payments or bounced cheques. The section reads: 109.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.