Amounts you received as a partner, shareholder, or beneficiary will be reported on the Schedule KPI, KS, or KF you received from the entity. Medical and Dental Expenses 1Medical and dental expenses (see instructions ). Enter the amount from line of Form M. If zero or less, enter 0. Multiplyline2by(.10). See full list on incometaxpro. When to expect MN property tax refund? When will my tax refund be mailed?

You must file yearly by April 15. You can download or print current or past-year PDFs of Form Mdirectly from TaxFormFinder. M2MT, Alternative Minimum Tax — FINAL DRAFT 10. Do not use staples on anything you submit. You’ll find help every step of the way.

Take just a few minutes to significantly save time on paperwork. The majority of the problems you will likely face in the completion process are already solved in it. Additional Information.

See the MInstructions for details. MN Dept of Revenue Response to COVID-19. Penalties If you make any statements on this form that you know are incorrect, you may be assessed a $5penalty. Use of Information All information on Form MWR is private by state law. Open form follow the instructions.

There is no extension available concerning the actual payment of taxes. This document should be completed on a computer and printed out. Get Form M1PR Instructions : Form M1PR.

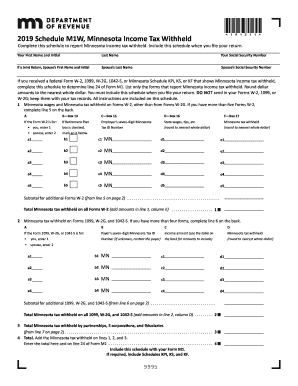

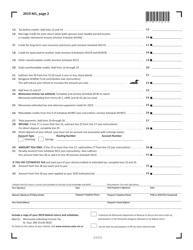

Homestead Credit Refund (for Homeowners) and Renters Property Tax Refund. Individual Income Tax Return. Minnesota Income Tax Withheld. Part-year and nonresidents. Postsecondary Child Care Grant Program Application.

Form M-by mail or other delivery service. Parent Plus Loan Request Form. Residents are required to file state income taxes using Form Meach year by April 15.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! The form features space to include your income, marital status as well as space to report any children or dependents you may have.

By filling out the form , you will see whether or not you owe money to the state or if you will receive a refund. Itemized deductions are reduced as your income exceeds $196($93if you are married and filing a separate return). Note that line is only for part-year residents and non-residents. The beneficiaries need this information to complete a. Can I E-file the form ? Within the e-file process, you will be asked what returns you wish to e-file.

What do I need to know about my refund? We leverage outside service providers who assist us with our marketing and advertising activities. Note: by opting-out of this tracking, you may still see Intuit advertisements, but they may not be tailored to your interests. Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on.

General Instructions Future.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.