What happens to bank accounts at your death? How to add a beneficiary to your bank account? Do bank accounts with beneficiaries or state? Office of Personnel Management. Some common beneficiaries include: 1. Children and grandchildren 3. Organizations, such as churches and universities 6. See full list on lawyers.

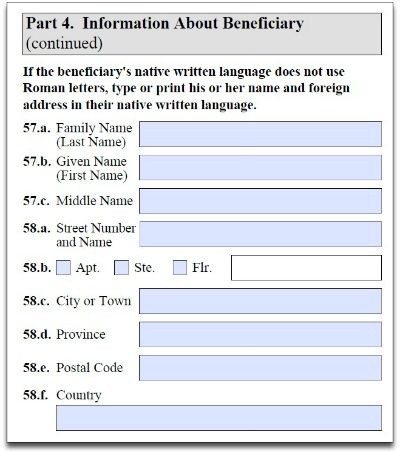

When you name a beneficiary in your will, use a clear and precise name that will be easily understood by the people who read your will. Name alternates, in case your first choice beneficiary dies before you. For people, use full legal names. You can also add the person’s relationship to you (like “spouse” “frien” or “brother”) or an “AKA” (also known as) for nicknames or former names.

For an organization like a church or school, contact the organization’s giving department to find out what name they want you to use. If it’s a big organization—like a state school—which name you use could have an effect on their taxes and on how they can use the money. You can also leave your executor a separate letter that provides additional information about your beneficiaries an.

If you do not name beneficiaries for your property—either in a will or through other estate planning tools—state law determines who will get your property. This is called dying intestate. Intestacy laws give your property to your closest relatives, like your spouse, children, parents, or siblings—depending on your state and your circumstances. The easiest way to do this is to use the online “wizar” which you’ll find by logging in here: My Account: Beneficiaries. Look at your annual statement, check the online wizar or call the ThriftLine at 1. A beneficiary designation, however, is different.

Anyone can sign as a witness as long as they are not a named beneficiary. Forms must be free of any erasures or changes. Sign and date the form. Unsigned and undated forms will not be processed.

Mail or fax the form to: DFAS U. Military Retired Pay. Contingent beneficiaries receive your assets if there is no living primary beneficiary. Note: Some retirement accounts or plans may require spousal consent (e.g., profit sharing, self-employe 401(k), Keogh) before you can add or change the beneficiary. The distributions typically come with tax consequences and sometimes various stipulations. You may leave each beneficiary a portion or establish an order of precedence.

Do you require an address for the beneficiary bank? If you require an address (for either the beneficiary or the ben bank) is it on all wires or only those more than $000? Beneficiary Physical address for Wire Transfer Employee at a bank ( $248M USA ) There seems to be confusion regarding whether or not a physical address is required per regulation on the beneficiary recipient for wire transfers? The MBSF contains beneficiary characteristics and enrollment information.

FEGLI enrollees and assignees use this form to designate who should receive the death benefits. Designation of Beneficiary. NOT required if the enrollee or assignee has not filed a previous designation of beneficiary and is satisfied with the standard order of precedence. Your VA Life Insurance Beneficiary is the person you have designated to receive your insurance proceeds in the event of your death.

It is very important to make sure your beneficiary information is always up to date. Beneficiary definition is - a person or thing that receives help or an advantage from something : one that benefits from something.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.