This means extra cash in your pocket. If you have work income, you can file and claim your EITC refunds, even if you don’t owe any income tax. EITC is widely recognized as one of the nation’s most powerful resources for lifting low-income people out of poverty. This year, the eligibility thresholds were lowered so more people could qualify. If you qualify for California’s EITC and the amount of the credit is greater than the tax you owe, you will receive a refund.

In its first year, the CalEITC boosted the income of about 380people, who received close to $2million from the credit. The credit is intended to help low and middle income people. What is the earned income tax credit and who qualifies? Does California tax income earned from other states?

What are California tax deductions? Can I claim the earned income credit? Even those who don’t earn enough money to owe federal income taxes may be eligible for an EITC.

Through this program, qualifying low income workers and families get significant savings on their income taxes. Earned Income Tax Credits totaling $42. If you’re marrie you must file a joint tax return. If not, you must be married to a U. If you are claiming qualifying children, you can be any age. Additional requirements: 1. Most centers can e-file your return for free.

You must live in the U. To find a local VITA Center, check the Franchise Tax Board or the IRS VITA Site List. IRS Publication 596is a comprehensive guide to the EITC. It includes information on program rules, calculating and claiming an EITC, rules regarding qualifying children, and sample worksheets.

Tax credits help reduce the amount of tax you may owe. If you pay rent for your housing, have a family with children, or help provide money for low-income college students, you may be eligible for one or more tax credits. California also has an earned income tax credit that may get you a refund even if you do not owe tax. See full list on ftb. Easy online preparation software.

Start Your Tax Filing Today! Modeled off of the Federal EITC, it is one of the most effective tools for lifting people out of poverty, as it helps people afford basic necessities. The CalEITC is a cash-back tax credit that puts money back into the pockets of California workers.

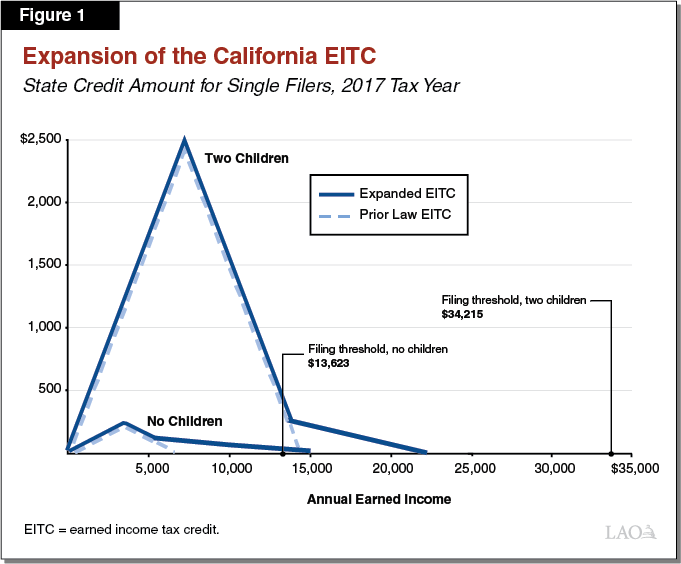

To qualify, you must meet certain requirements and file a tax return, even if you do not owe any tax or are not required to file. A tax credit means more money in your pocket. EITC reduces the amount of tax you owe and may give you a refund. It reduces the amount of tax you owe and may also give you a refund. For income between $18and $300 the tax credit decreases by $0.

How do I claim the credit ? Just file your California tax return. The Governor and Legislature of California , in a bid to relieve some of the tax burden on lower- income taxpayers, created an earned income tax credit (EITC) for the state of California to supplement the federal earned income tax credit. The California EITC is a refundable state income tax credit for low- income working individuals and families. Your federal adjusted gross income and California wages are less than $3001.

People without kids can qualify. The amount depends on income and number of children. We have the EITC Assistant in English and Versión en Español.

We also have versions for the current tax year and for prior years. Make sure you use the right assistant. Income limits and credit amounts change from year to year.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.