When you have an accurate number, you can use the regime’s benefits to save both time and money. Read our full article to find out which supplies are included in the threshold limit of GST. What is aggregate turnover? Can you pay GST with aggregate turnover? Is a required to register under GST?

Should I pay GST on coconuts? X is a farmer with an annual turnover of Rs. Aggregate turnover is an all-encompassing term covering all the supplies effected by a person having the same PAN. Turnover, in common parlance, is the total volume of a business. A is a farmer with an annual turnover of Rs.

Here’s an example to help you understand the concept of aggregate turnover. A also supplies plastic bags along with his crop and charges separately for this. A owns a tea estate with an annual turnover of Rs. This activity is exempt from GST. Bipin will also require to take registration, even if the aggregate turnover in respect to the workshop is less than Rs.

Maharashtra, registration under GST is not required. Since the aggregate turnover is less than Rs. Example 2: If in Example the head office was situated in Assam.

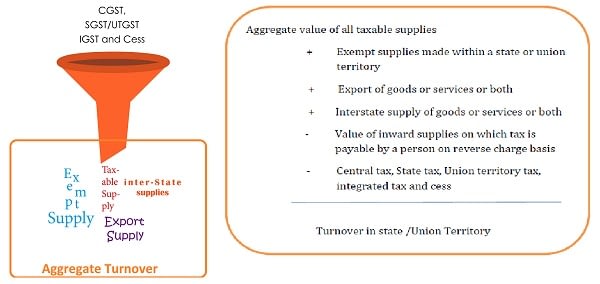

While computing value of aggregate turnover under GST all the proceeds of activities done by the taxpayer on a pan-India basis are added up. Relief from paying GST on advances post 13. Distribution of credit of the Input Service Distributor (ISD) is based on ATO of each registration. State if ATO of PAN exceeds.

Example : If Sales of goods are lacs and other interest income i. GST is lacs, then such a person is not required to take GST Registration as per explanation under Section 22. The above explanation is only for the purpose of intrastate supply of goods. It is not applicable to the supply of services.

Example , If you have raised total invoices whether they are of local supplies, exports or interstate supplies amounting to Rs. Tag: aggregate turnover under gst with example. Hey friends, in this post, we will learn how to calculate the aggregate turnover under GST. Aggregate Turnover Meaning and Limits Under GST - Registration - Indirect Taxation - Duration: 41:25.

As per CGST act Section 2(17), Business is very wide. We also know that renting is also covered under business in GST , though with the power of sec1 according to notification, residential house renting for residential purpose is exempted supply of service. The basic intent of a threshold exemption is to keep the small ticket suppliers away from the compliance rigors of the.

Turnover , in common parlance, is the total volume of a business. GST registration is mandatory. It is mandatory for every business to get registered under GST if the aggregate turnover in the preceding financial year: is more than Rs.

Lakhs in case of services. Turnover is the amount of money a businessman is making in a particular time period. For example , if a person is having, say branch offices in different parts of a country under a same PAN filing single income tax return, his turnover for all such offices shall be aggregated for the purpose of aggregate turnover under GST. Author’s Comment-If business operation in more than one category of states, Lower threshold limit will prevail for calculation of aggregate turnover under GST. Its turnover in the current FY from Assam showroom is Rs.

Check our frequently asked questions for examples to help you and your clients understand how they may calculate their GST turnover for the purposes of enrolling in the JobKeeper Payment scheme.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.