When does VAT become payable? Or in other words output VAT is found on invoices going out from your company. It is a form of taxation that focuses on how much an individual consumes opposed to. The amount of VAT that the user. Vat payable is the amount of vat collected on behalf of the tax authority and payable to them.

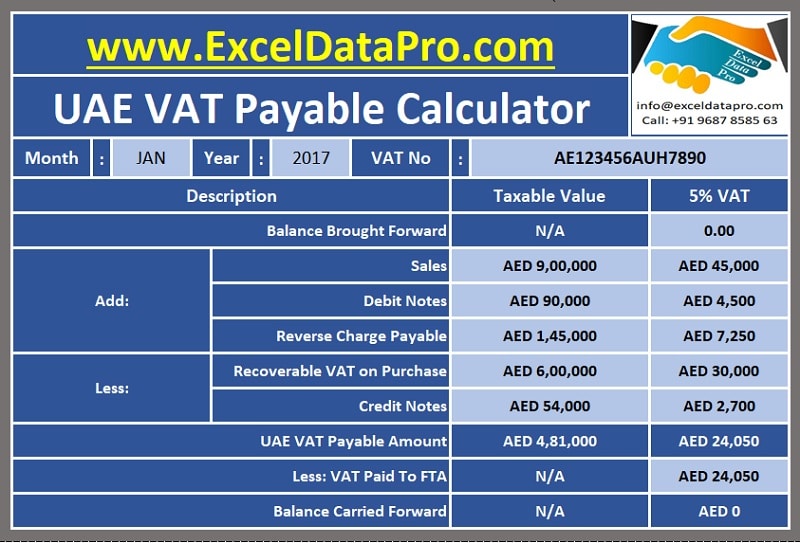

That is where the computation and confusion comes in. Tax payable is equivalent to Output VAT minus Input VAT. I included sample spreadsheet computation here to provide more details. Of course this does not represent the business world because there are other things to consider (like valid expenses, withholding taxes, etc.). Calculating the VAT (Value Added Tax) element of any transaction can be a confusing sum at the best of times.

Following these simple steps can help you get it right: Take the gross amount of any sum (items you sell or buy) – that is, the total including any VAT – and divide it by 117. General VAT rate is ten percent. Using indirect subtraction method with invoice to calculate value added tax payable. The business should just be collecting it and then paying it over. The VAT amount should therefore not be included in your salary (the money paid to you).

Value-Added Tax is commonly known as VAT. VAT is an indirect tax on the consumption of goods and services in the economy. Revenue is raised for government by requiring certain businesses to register and to charge VAT on the taxable supplies of goods and services. Payment options for your VAT bill, including VAT MOSS - Direct Debit, credit or debit card online, Faster Payments, online banking and standing orders.

If the rate is different, add 1to the VAT percentage rate and divide by that number. The Output VAT is deducted with the amount of Input VAT you have any given period. The difference (output-input) becomes your liability to the tax office. Suppliers, manufacturers, distributors, retailers and end consumers all pay the VAT on their purchases.

Businesses must track and document the VAT they pay on purchases in order to receive a credit for the VAT paid on their tax return. Manufacturer, wholesaler and retailer of taxable supplier pays vat on the value addition but they are entitled to take rebate of such vat. Payment generates an accounting entry to a VAT input intermediate account when the voucher posts. This entry reverses and posts to the VAT input account when the payment posts.

The VAT use type determines the percentage of the VAT input that is recoverable and the percentage that is a nonrecoverable amount. Value Added Tax ( VAT ) is a tax charged on the sale of goods or services and is included in the price of most products and services that we use every day. Where the output tax exceeds the input tax amount, the difference must be paid to FTA. Payment of VAT due and payable is the filing of the VAT returns within 2twenty (20) days from end of month for monthly returns using BIR Form No.

M, and within twenty-five (25) days from quarter-end for quarterly returns using BIR Form no. Every payment through bank account will decrease our current asset, so bank account will credit. We have to show only excess of VAT output over VAT Input because the VAT which we have to pay already through purchasing need to pay again. This is usually the customer or an import agent acting on the customer’s behalf.

If you are recording both input and output VAT , where VAT is not included on the invoice and you may be liable for VAT , but it is not payable to the supplier, the system creates a separate VAT liability entry during voucher posting. The VAT declaration point determines the date on which VAT is recognized. Value Added Tax is due and payable within days after the end of the tax period to which it relates. VAT incurred by businesses that does not relate to their onward making of taxable supplies (whether exempt or from 'non-business' activities) may not be offset from the amount of VAT that is payable to HMRC.

A separate scheme, called The Flat Rate Scheme is also run by HMRC. VAT payable by the producer on his current transactions. Now, Tax payers can make e-Payment for many of the tax categories of Commercial Taxes Department as shown.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.