You can print other Federal tax forms here. Based on the information that is entered into the waiver input screen, a unique record number is automatically created for each waiver and letters are create verified and printed. See full list on irs. A hardship exists if a taxpayer is unable to pay reasonable basic living expenses.

More from HR Block The IRS may agree that you have a financial hardship ( economic hardship ) if you can show that you cannot pay or can barely pay your basic living expenses. Many taxpayers aren’t aware of IRS hardship procedures introduced by the IRS hardship program, and the opportunities it creates for individuals suffering from a tax hardship. Under IRS hardship rules, if a person would face unfair financial hardship after the collection of their outstanding taxes, they may be able to qualify for an. North County Family Left In Hardship After Losing Breadwinner To COVID-19.

ECONOMIC HARDSHIP REPORTING PROJECT. Broadway, 10th Floor New. On average this form takes minutes to complete. Understanding the criteria and documentation required to substantiate a hardship situation is vital when dealing with the government. How the IRS Defines Financial Hardship The IRS considers an economic hardship the inability to pay reasonable and necessary living expenses.

Confirm If You Qualify for the IRS Hardship Program First. If you qualify for the CNC tax program for financial hardship reasons, the IRS temporarily pauses all collection activity on your account. However, you still owe the IRS money and interest continues to accrue on your tax amount owed. If you owe more than $100 a federal tax lien will show on your credit report. Hardship Relief for Tax Debt Taxpayers who have a tax debt and are also experiencing a financial hardship have resolution options available.

The Offer in Compromise and Partial Payment Installment Agreement are examples of IRS plans that allow for a reduction in the tax debt. To be declared uncollectible by the IRS or currently not collectible (CNC), you will have to prove to the IRS that if they were to collect taxes owed to them, it would create an unfair economic hardship. Filing for Hardship with the IRS: Being Declared Uncollectible. If you truly cannot afford to pay your IRS tax bill, you may qualify for hardship status. Hardship status applies to individuals, sole-proprietors, partnerships, and limited liability companies (LLCs).

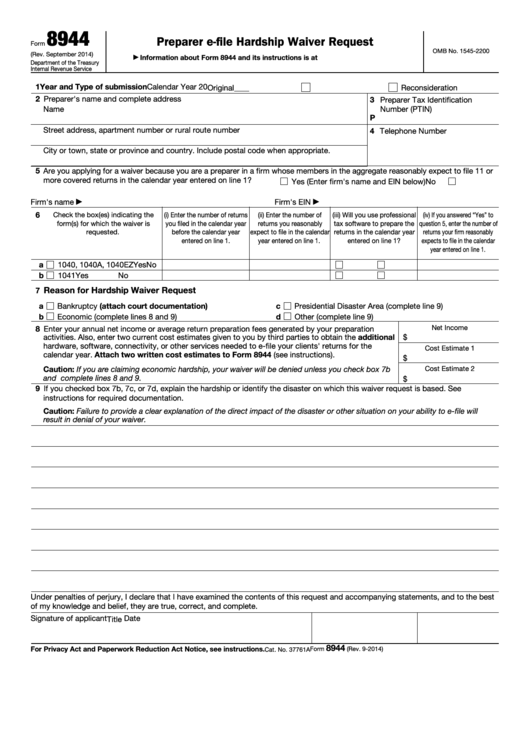

Moreover, it is also called currently not collectible (CNC) or status 53. However, those who experience financial hardship and meet certain criteria may be able to file an IRS hardship request. Fill Out The Preparer E-file Hardship Waiver Request Online And Print It Out For Free. Caution: If you are claiming economic hardship , your waiver will be denied unless you check box … year tax return, use the form and instructions revision for that tax year. Forms and Instructions.

The IRS forms you will need to complete can be found on the IRS website. The IRS will request financial information to demonstrate hardship. The Internal Revenue Service (IRS) may, at times, look at a taxpayer’s debt ratio.

If they deem it necessary, they may delay account collection for that particular person. This is a “currently not collectible” type of action, and one that you can request by writing a hardship letter to them. Employees no longer routinely have to provide their employers with documentation proving they need a hardship withdrawal from their 401(k) accounts, according to the Internal Revenue Service. The program placed a special focus on small businesses in industries that continue to experience economic hardship as a result of the pandemic.

There are still businesses that need help,” Bennett said. Businesses that have suffered significant losses during this crisis should keep an eye out for future rounds of the BIG program. PDF download: Sliding Fee Discount Program – NHSC – HRSA.

Cash Flow Statement - Get the latest Financial Statements of , Cash Flow Reports and more on The Economic Times. Reddit gives you the best of the internet in one place.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.