A joint sponsor must meet all the same requirements as you, except the joint sponsor does not need to be related to the immigrant. The joint sponsor (or the joint sponsor and his or her household) must reach the 1 income requirement alone. You cannot combine your income with that of a joint sponsor to meet the income requirement. For green card and immigrant visa applications, the sponsor ’s income and assets must be enough to support the people who depend financially on the sponsor (also called household members or dependents), at 1 of the income level that the government believes puts a person into poverty.

What are the income requirements for a sponsor? How much money do you need to sponsor Your Parents? What do I need to know about sponsoring parents? When do you need to co-sign a sponsorship application?

Income Requirements to Sponsor a Relative. The simplest way to check if you qualify as a sponsor is to review Form I-864P, HHS Poverty Guidelines for Affidavit of Support. Use this form to determine the minimum income requirement needed to sponsor most family-based immigrants.

Your current income is the gross amount you expect to earn this year. Green Card One of the U. This income can be your individual earned or retirement annual income. You may include evidence supportingyour claim about your expected income for the current year if you believe that submitting this evidence willhelp you establish the ability to maintain sufficient income. See full list on immihelp.

However, if your income alone is not sufficient to meet the requirements for your household size, it can be met usingany of the following combinations: 1. They are household members who are willing to be jointly responsible for the sponsorship. Proof of residency in your household and relationship must be submitted. Even when given the contractual nature of the I-86 affidavit of support, and the prohibition of most federal means-tested public benefits to most aliens, consular officers still need to look beyond a “sufficient” affidavit of support for other public charge issues. Section 212(a)(4)(B) lists the factors a consular officer should take into consideration when making public charge determinations.

An affidavit of support, Form I-86 is only one of the factors to be considered. Consular officers will continue to consider the totality of the sponsor’s and applicant’s financial situations to confirm to the extent possible that the applicant will have adequate financial support and is not likely to become a public charge. A credible offer of employment for the visa applicant cannot replace or supplement an insufficient affidavit of support.

The law does not make any provision for the consideration of offers of employment in lieu of the I-864. Similarly, an offer of employment may not be counted in reaching the 1percent minimum income. Such an offer can be taken into account in assessing the applicant’s ability to overcome any public charge of grounds of inadmissibility. As long as the I-8wassubmitted to a consular officer within one year ofthe date it was signe a new I-8isnot required. The evaluation will be made based on the poverty guidelines in effect on the date of filing of the I-864.

You may count income that is not subject to taxation (such as a housingallowance for clergy or military personnel), as well as taxable income. You would have to prove the nature and amount of any income that is not included as wages or salary or other taxableincome. The filing date of the application is extremely important.

The sponsor (i.e. the Canadian citizen or the permanent resident of Canada) needs to meet the minimum necessary income for the last three consecutive years immediately before the filing date. The sponsor’s spouse or common-law partner may also co-sign the application. In this case, you may add both incomes together.

No other family members may be a co-signer. The income of the parents does not count. The only acceptable source of verifying the income is the Notice of Assessment (NOA) by the Canada Revenue Agency (CRA). Alternatively, you may consider the Option C Printout by CRA. Consequently, look at line 1of the NOA to identify your income.

The minimum necessary income depends on the family size of the sponsor. Of course, it also includes the sponsored persons. As another example, if the sponsor has a spouse and two dependent children and they are sponsoring her mother and father then the number is (i.e. the sponsor , the spouse, two children, and two parents). For example, if the sponsor is single and she is sponsoring her mother then the number is 2. The following table shows the minimum necessary income based on the total number of family members and the sponsored people.

Click here for more information about the sponsorship process. Al Parsai, MA, DTM, RCIC Regulated Canadian Immigration Consultant Ashton College Instructor– Immigration Consulting Disclaimer: This article provides information of a general nature only. It may no longer be current. All the characters in the articles are fictional, unless otherwise clearly stated.

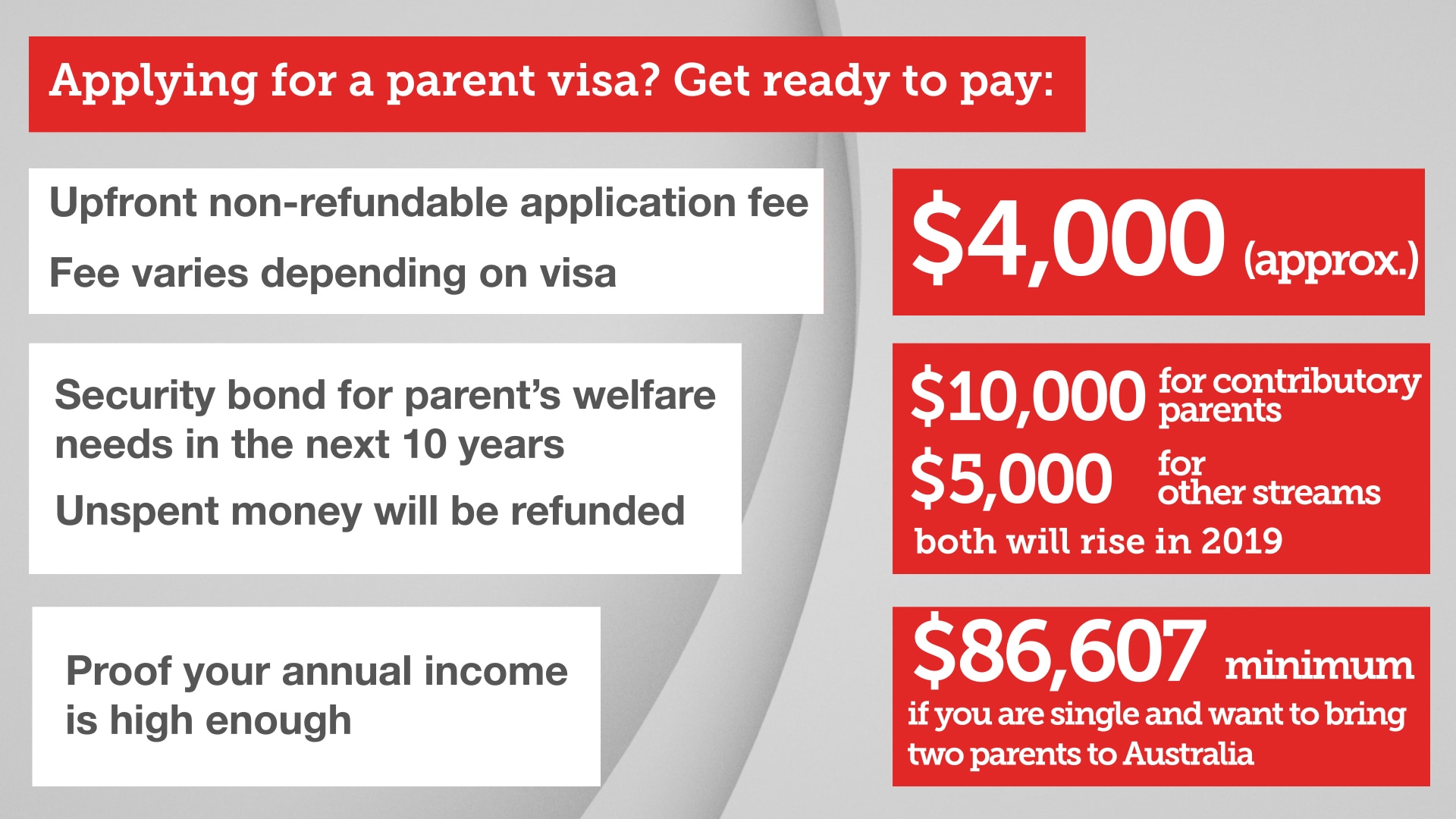

Any resemblance in names, d. An individual who wants to sponsor their two parents now needs an annual income of $860 up from around $40under the previous rules, while a couple sponsoring two parents now needs a. The new financial requirements for the Parent Resident Visa can only be met through the income of the sponsor and their partner. A sponsor may not rely on a household member’s income from illegal activities, such as proceeds from illegal gambling or drug sales, to meet the income requirements , even if the household member paid taxes on that income. A Form I-864A is jointly completed by two individuals: the petitioning sponsor and the household member.

Even if you meet or exceed the income requirement, there is no guarantee you will not receive an RFE (Request for Evidence) or be asked for a joint sponsor by the government. To find out more about the income requirements , go. We must approve the sponsorship.

If your sponsor dies.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.