Should you add beneficiaries to your accounts? Does designating a beneficiary of a bank accoun? Does PNB net banking take time to add beneficiary? Do you have to have a beneficiary for a checking account? The POD is also known as a transfer-on-death, or TO account, also called a Totten trust.

Your bank or credit union will add the beneficiary to your account free of charge. An account holder may choose to list both of their children as equal beneficiaries. You can change the beneficiary as often as you like. However, an account holder can also choose to list individuals in unequal amounts.

Distributing Property in a Will vs. Through a Beneficiary Designation. Understanding the importance of beneficiary designation on bank accounts is a critical part of estate planning.

Anyone can add a POD beneficiary to an existing account by providing the financial institution with some basic information about the named beneficiary. Your financial institution can provide you with a form for each account. The beneficiary designations that you make on a retirement account like an IRA generally supersede any other instructions you leave , including your will. So if your will states that your spouse is your IRA beneficiary , but the IRA itself designates your children as your beneficiaries , your children will inherit your IRA.

Checking accounts do not require beneficiaries , but consumers can add them upon request. The balance of the account will be distributed to your beneficiary and becomes taxable to them in the year you pass away. The assets will be transferred to your estate and treated as taxable income on your final tax return. It’s a good idea to consult with a tax professional if you have. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

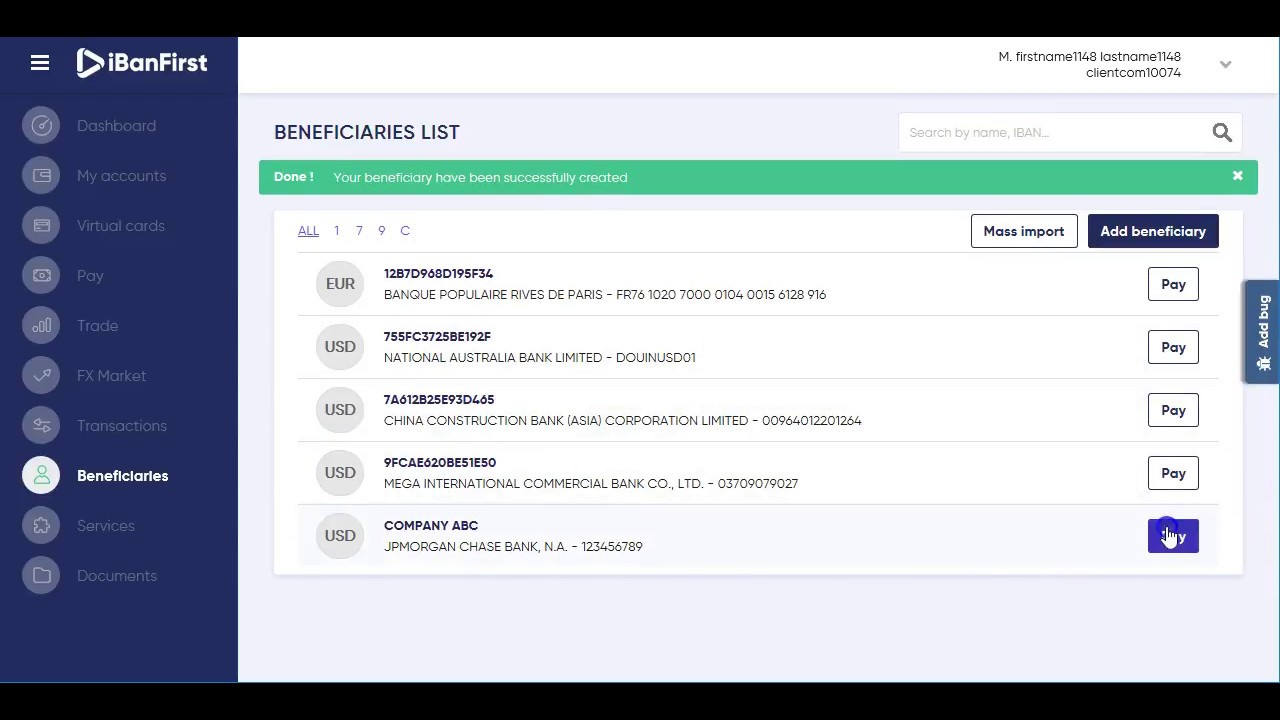

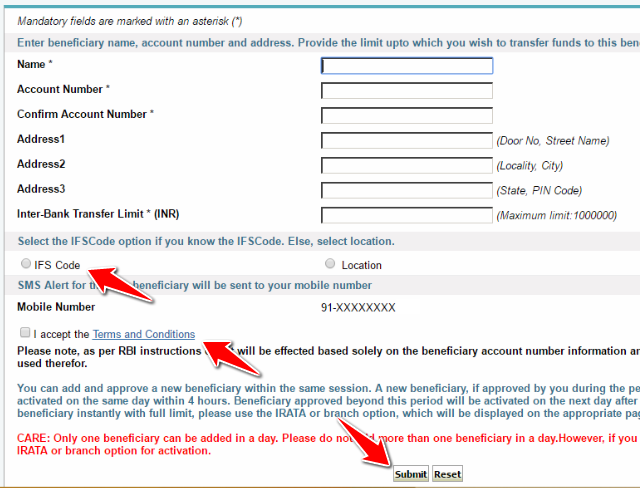

You receive additional coverage of $250for each account beneficiary. Sometimes your bank will ask for this information when you ’re opening a new account , but they don’t always. And sometimes you can ’t add or change beneficiaries online. Each bank will have its own forms for you to fill out, so make sure you provide the information so the bank can add the new beneficiary.

Adding a beneficiary to a joint bank account is a good way to avoid probate for the money in that account. In order to add a beneficiary please do the following: 1. Fill in the requested information (The form is editable, so you can type everything before you print it.) 2. Print out the form 3. With certain types of bank accounts , you can designate a “beneficiary ” who will be entitled to take ownership of the account after your death. Since your beneficiary ’s rights arise automatically, and the process of transferring account ownership is handled by your bank , bank. Those other four beneficiaries could be friends or charities.

For example, you can leave 99. If the bank doesn’t allow you to divide the funds that will go to the beneficiaries in your own percentages, you can have separate accounts for each beneficiary. The beneficiary named by the deceased person can simply claim the money by going to the bank with a death certificate and identification.

The bank should have the document in which the account owner designated the POD beneficiary. Jointly Owned Accounts. If the deceased person owned an account jointly with someone else, in most cases the. Most banks will allow you to add a beneficiary to your account free of charge, and most will also allow you to change the beneficiary as often as you ’d like. As with naming an authorized signer, you ’ll typically need to visit the bank in person in order to fill out required forms and provide proper identification, however some financial.

Designations will differ based on the account type, as follows: Individual accounts : If beneficiaries are added to individual accounts , the. Are beneficiary allowed on sole proprietorship accounts ? Answer: Answer by Ken Golliher: For purposes of ownership, not the application of most consumer protection laws, a sole proprietorship is simply an individual account to which your institution has added a dba name to the title. If you ’ve set up a living trust to avoid probate proceedings after your death, you can hold a bank account in the name of the trust. After your death, when the person you chose to be your successor trustee takes over, the funds will be transferred to the beneficiary you named in your trust document.

Any amount paid to beneficiaries that represents an increase in the FMV after the date of death is taxable to the beneficiaries and has to be reported by them as income. Such payments will appear in box 1Tax -Free Savings Account taxable amount in the Other information section of a T4A, Statement of Pension, Retirement, Annuity, and.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.