Reader Question: I am buying a commercially zoned property for personal use. I will be storing personal items and not operating a business. The value of the property is $30dollars. Will I be required to get a commercial mortgage? Also, would I be required to carry commercial property insurance or would regular property insurance be.

Here are a few: Investment potential. Owning is an investment that can increase in value over time. Typically, and depending on the. Make money advertising. Cross-advertising with local or.

Is buying commercial property the same as buying a home? Should you buy commercial real estate? Can personal use property be insured? What are the benefits of a commercial property lease?

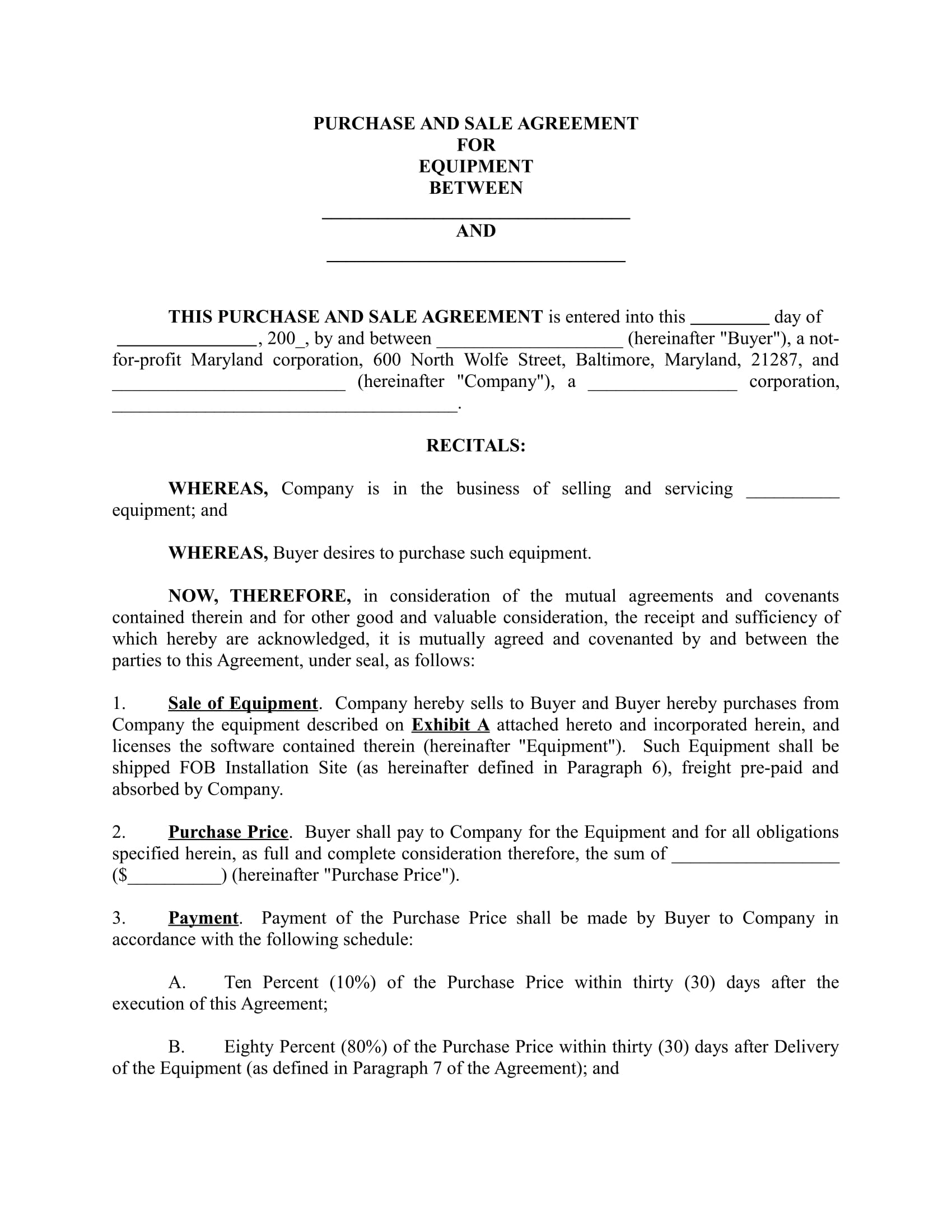

Whichever kind of commercial real estate you invest in, you have the potential to generate a lot of income, including an annual return on the purchase price that can be over percent. Financing – Most small businesses today buy their buildings through SBA funding. You still go through a bank or lending source , but the loan is ultimately split and the SBA finances a portion of the loan (usually a little less than half). Conversely, the primary goal of investment property is for the purchaser to yield some sort of profit from its. You may also want to evaluate if you acquire the property using a commercial loan and live in it you may actually have defrauded your lender which is a federal crime.

If living in the building is your primary purpose and you obtained a loan for commercial purposes it is fraud. Commercial properties generally have an annual return off the purchase price between and , depending on the area , which is a much higher range than typically exists for single family home properties ( to at best). IRS Rules for Deductibility for Personal Use of Rental Properties. IRS rules allow you to live in your rental property , but it may cost you.

The time you stay in the property turns it into a part. Register and Subscribe now to work with legal documents online. Access investment opportunities across assets like marine, real estate, and art. Target income generation with short durations to help you realize your ambitions sooner.

Understand your motivations for investing in commercial real estate. Assess your investment options. Partner with the right team. Find the right property in your market.

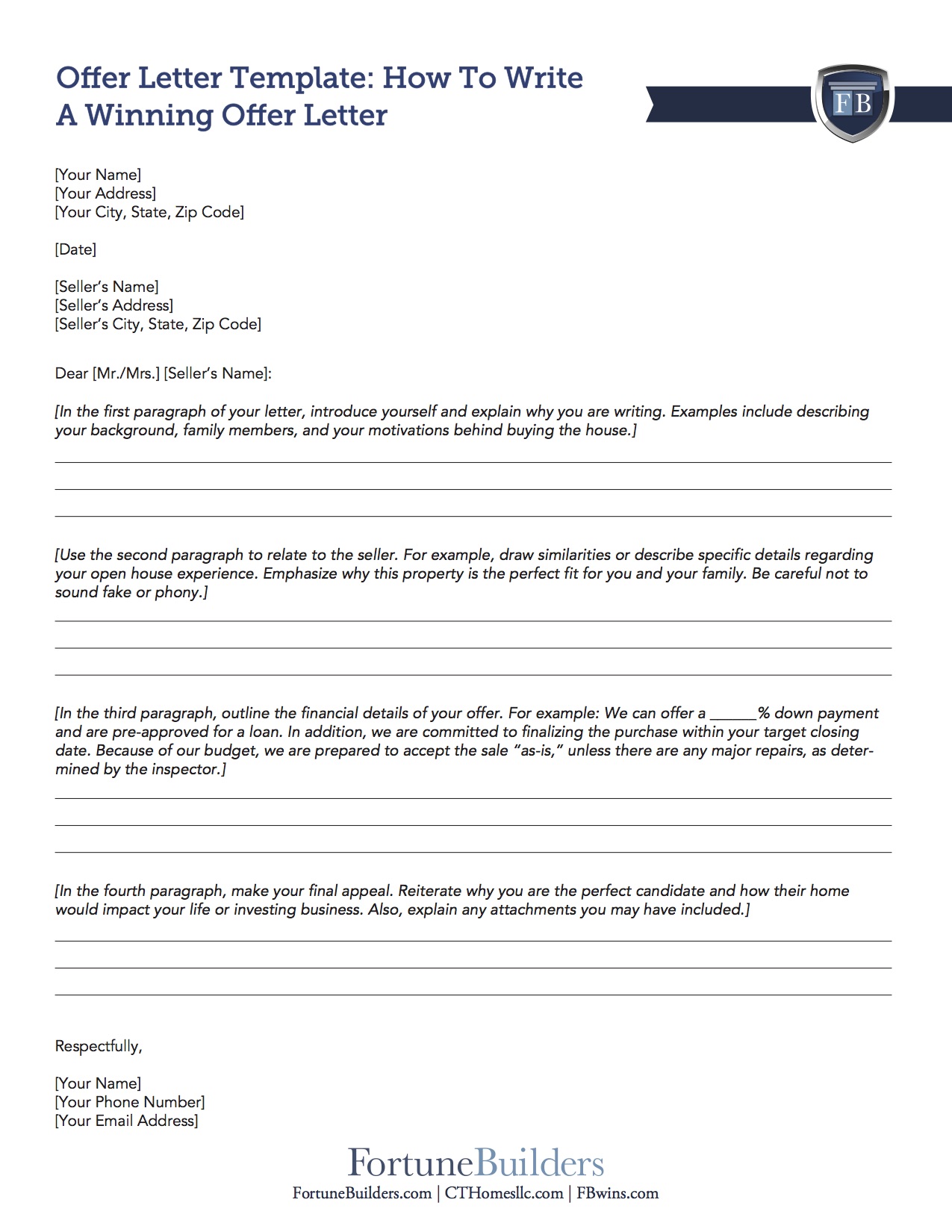

How to Buy a Commercial Property : An In-Depth Review. Consider hiring a commercial real estate agent that specializes in the types of transactions you hope to complete, a commercial real estate attorney well-versed in the laws of commercial real estate , and even a certified personal accountant (CPA) to make sure the deal goes according to plan. First, it is important to discuss the sector within which you are purchasing: industrial, multifamily, retail, office or mixed use. There are a number of professionals that can help, so.

The dwelling, however, must be an area of land no more than two hectares and the main use of the property must not be for domestic or private purposes. Step 3: Review the property asset rules. After all, when you buy a commercial property, you’re essentially buying the leases and the property comes for free.

Contracts imposed on the property, such as employment contracts, service contracts, and warranties, all need to be scoured over with a fine-toothed comb. All attorneys are not created equal. When you have paid off the loan, you own it outright. Attorneys specialize in areas of law.

Leasing commercial property means renting it from its owner. You can rent on either a short- or long-term basis. The SBA offers two loan programs that can be used for commercial real estate: 7(a) loans and 5loans. While 7(a) loans are general-purpose loans, 5loans are specifically designed for the purchase or refinance of commercial property. Depending on the type of property you plan to buy, the location, the age of the property , and what your intended use is, there is a great deal of specific and important information you should know.

What’s the benefit of buying a commercial property with your pension? Firstly, if your business already owns the property, then purchasing within a pension can release capital back into your business for investment elsewhere. Or if you are buying new premises, using your pension can provide a very tax-efficient way to buy that property.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.