What is the nanny tax? If you hire people to do work around your house on a regular basis, they might be considered household employees. According to the most current IRS statistics, approximately 190household employers nationwide file this mandatory form each year. Form W-for reporting wages paid to your employees.

Form W-for sending Copy A of Form (s) W-to the Social Security Administration (SSA). Here is a list of forms that household employers need to complete. Register and subscribe day free trial to work on your state specific tax forms online.

Prevent new tax liens from being imposed on you. Access IRS Tax Forms. Complete, Edit or Print Tax Forms Instantly. No Installation Needed. Convert PDF to Editable Online.

If you hired someone to do household work and you had the right to control the details of how the work was performe you had a household employee. As a new household employer , you’ll want to be well-versed on this tax form as you prepare for tax season. You might want to hire an accountant to help you set up payroll processes and prepare your tax filings.

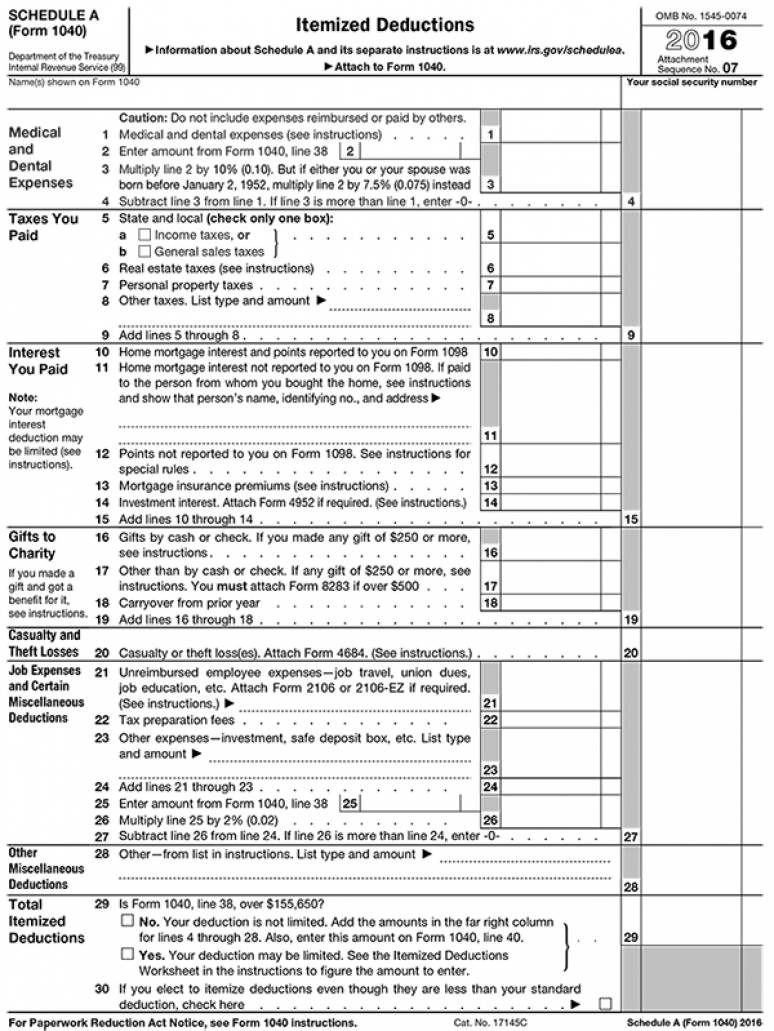

The schedule provides tax rates for given ranges of taxable income, as well as for. A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. These commonly include things like significant amounts of interest income, mortgage interest or charitable contributions. This misstep can make more work for the family, increase the risk of penalties, cause dual reporting to the IRS , and create other accounting issues. This is the form where, when filing your New York sales tax return, you report sales of clothing and footwear eligible for New York’s clothing sales tax exemption.

Those tax are: Social Security taxes paid and withheld from their caregiver. Medicare taxes paid and withheld from their caregiver. HR Block Online and HR Block Software get unlimited sessions of live, personal tax advice with a tax professional with Online Assist and Software Assist for a fee.

Standard live chat hours apply (7:a.m. to 7:p.m. Mon.-Sun. (all times CT). Form 9however, must be filed and paid every quarter.

Even if there was no household payroll in a quarter, the family using a form 9return must file every quarter. It’s an annual filing that’s prepared with your personal income tax return income. Form 94 however, is filed every quarter even if you didn’t pay an employee during that period. Claim only the property taxes on one acre of land and the buildings on it. Review Tax Topics and FAQs on self-employment tax and income found on IRS.

Do Not Procrastinate In Filing Your Taxes This Year. Let Our Experts Help You Prepare. Our Goal Is To Provide Fast And Accurate Tax Preparation Service At Reasonable Rates.

Schedule H , Household Employment Taxes. A) Did you pay any one household employee cash wages of $0or more in 20XX? If any household employee was your spouse, your child under age 2 your parent, or anyone under age 1 see the line A instructions before you answer this question). To apply, file the D. If you file an income tax return, you or your tax preparer can file the D. They will also need to issue a W-to their nanny by the end of January and submit a copy, along with Form W- to the Social Security Administration by the end of January. Visit the District’s new online tax portal to view and pay your taxes.

Repayment of first-time home buyer credit. Health care individual responsibility. Talk to HR Block if you need any help filing taxes for on behalf of a partnership.

Last year, many of the federal income tax forms were published late in December, with instructions booklet following in early January due to last minute.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.