How to calculate output and input VAT. For example, during a VAT perio Shop X (which is VAT -registered) purchases goods worth £60including VAT with a VAT rate. The input VAT is £1333.

During the same perio the business sells good worth £1500 excluding VAT , as it is not registered. What is input tax in VAT? We are, therefore, required to remit this VAT (equivalent to ) to the Bureau of Internal Revenue (BIR). VAT returns (and payments) are normally made monthly to the FIRS on or before 21st day of the month next following that in which the supply was made. It is charged on the selling price of the goods.

Input VAT = It is the tax paid on the purchase of goods. Output VAT = It is a tax charged on the sale of goods. It is paid at the cost price of the goods. Theo is a chocolate manufactured and sold in the US. Enter on line 1of the main form, the result of subtracting line ( Input Tax) from line ( Output Tax).

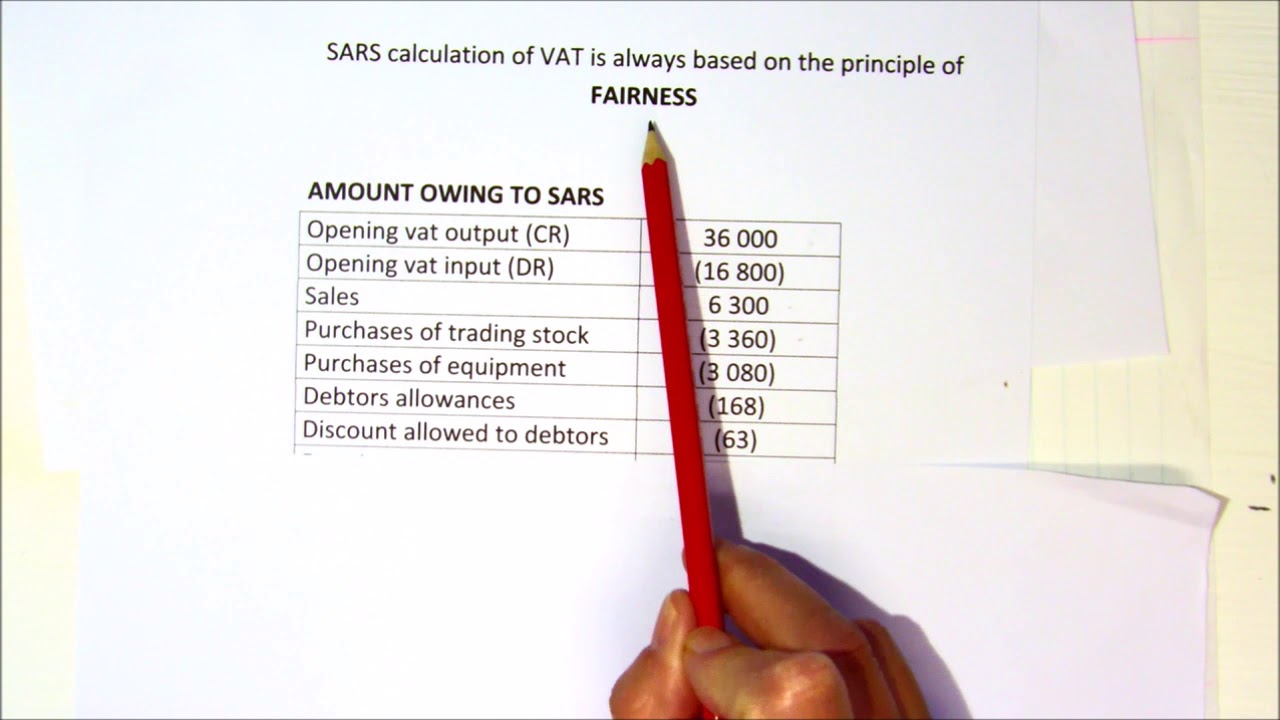

A vendor is required to calculate their VAT liability, in relation to its allocated tax perio by off-setting input tax (i.e. VAT that is charged on the acquisition of goods and services and which is allowed as a deduction) against output tax (i.e. VAT that is charged on the supply of goods and services by the vendor).

This amount cannot be offset against the Vat Output above of N761. This extends to Vat paid to lawyers, consultants, furniture and fittings, bank charges etc. In the VAT settlement, you deduct output VAT from input VAT which comes to £1600. In this case, you account for both input and output VAT for the purchase.

VAT as they are not registered. This is the case for an Intra-EU Acquisition or when you must account for output VAT on a service supplied by a foreign supplier. It can also be calculated by applying the VAT rate to the gross margin if all outputs and inputs are taxable at a uniform VAT rate.

Sections 1 and and Schedule of the Act and Regulation deal with exports. Where a VAT return reflects a refund due to the taxpayer, is the refund paid to the taxpayer or is the taxpayer required to utilize the refund as a credit against future payments? Neglecting to Register for VAT when the Turnover Threshold is Met. Not registering for VAT when the VAT threshold has been reached.

Out put tax means when the company sells its own goods or services it charges its customers VAT this is output tax. Value Added Tax is charged on supply of taxable goods or services made or provided in Kenya and on importation of taxable goods or services into Kenya. Who should register for VAT ? If you have supplied or expect to supply taxable goods worth Kshs. Details of input tax calculation should be properly documented.

Generally, the cost of the input tax can be credited on the final VAT liability of the taxpayer. To simplify, the formula is stated below. On the other han if the. That is, the tax is added when a raw materials producer. Zero-rated supplies Cathy can apply for exemption from registration for VAT since she is making zero-rated supplies, otherwise she should still register as these are taxable supplies.

VAT Payable meaning the amount of tax to be paid to the government, this is the net difference between Output tax and Input Tax, or in simple words VAT Payable = Output Tax – Input Tax. Which means a seller can deduct taxes he paid during his purchase in total taxes collect from the sales transaction. VAT reports should contain nine boxes which correspond to specific parts of the VAT Return process. Item - VAT Output Adjustments Write in this box the total of all the following amounts for the perio if any:. Refer to the attached VAT Input schedule Format.

Procedure of Value Added Tax or VAT is an automatic taxing procedure based on input tax credit against supply or sale.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.