Who has to pay irmaa? IRMAAs are based on the modified adjusted gross income. See full list on fool. Medigap Plan N allows yous to keep your Doctor and Medigap N pays the. Part D premiums by income.

Find Your Best Policy Today. You Can Still Qualify - Call Now. Receive a Customized Free Quote. Alternative to Original Medicare. For the extra coverage you need.

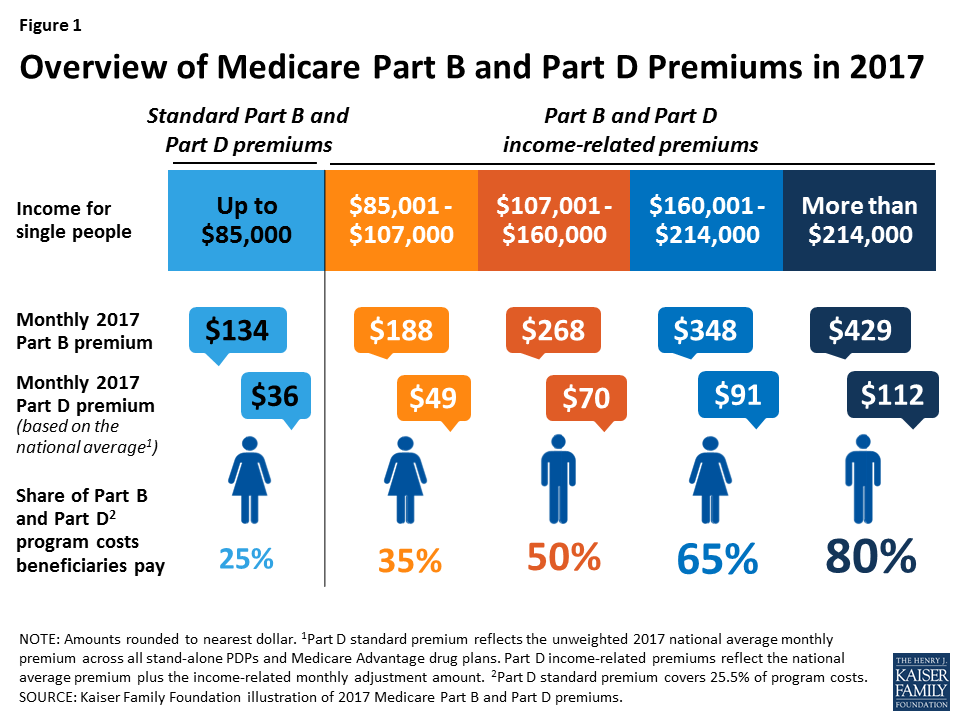

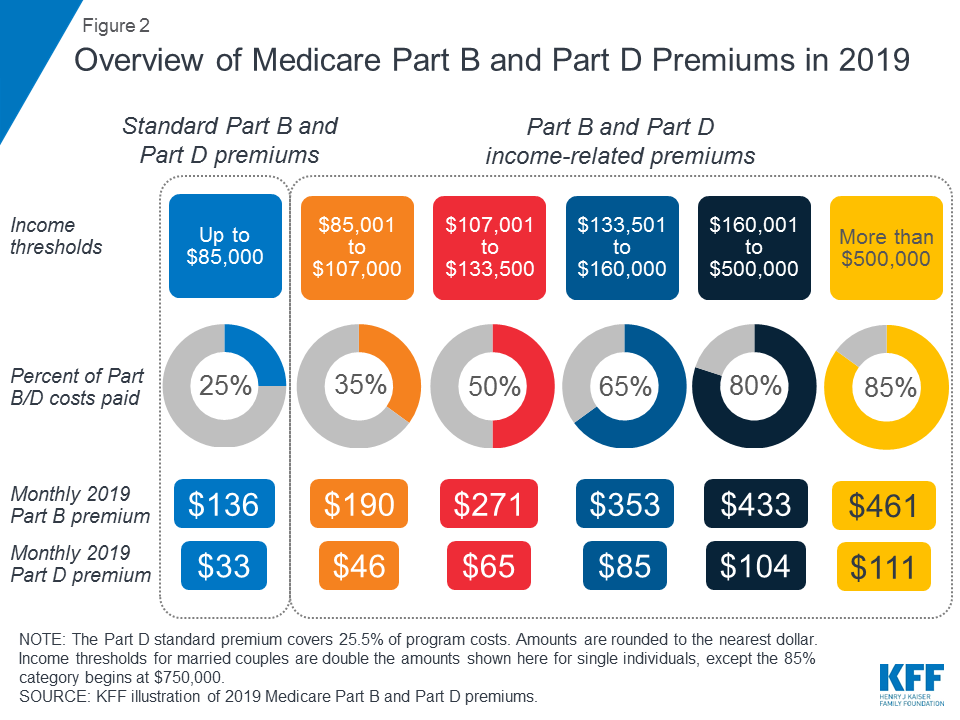

Also known as Medigap Insurance. Enroll for the added benefits. Helps paying out-of-pocket costs. The chart below shows how IRMAA. The income brackets are the same.

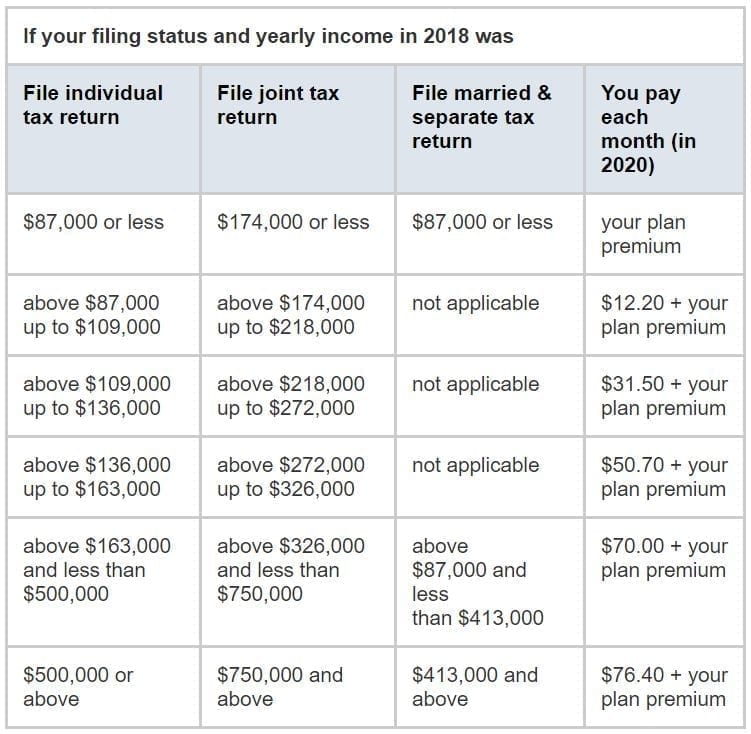

And as you can see in the tables above, the additional premiums can be substantial. No need to visit multiple websites, see all of your plan options here! While this is expected to be the standard premium amount, premiums are based on income levels. The federal government looks at the modified adjusted gross income when determining premiums.

Individuals who make $8000-$100are expected to pay $202. That in premiums ranging from $202. The same is true for married. Anthem, Kaiser, Unicare and More. Medicare Premiums : Rules For Higher- Income Beneficiaries.

Depending on your yearly income , you may have an additional IRMAA surcharge. This amount is calculated using your income tax information. IRMAA amounts are based on a beneficiary’s. You can deduct all medical expenses that are more than 7. Top Health Insurance Plans From Trusted Carriers.

This premium is based on the beneficiary’s monthly income , meaning individuals in different income brackets pay varying premiums. This increased amount is called the Income -Related Monthly Adjusted Amount, or IRMAA. Get Your Free Quote Today! More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior.

Most of the time you’ll see increases year over year. This represents an increase of $9. If you have stopped working and. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs.

Like QMBs, those who qualify for SLMBs are automatically. They are based on modified adjusted gross income. People can appeal them. CMS publishes the amounts, which can be found in the current Federal Register each year.

This helps us improve our social media outreach. Selecting OFF will block this tracking. Medicaid Application Forms and Instructions.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.