What is a contingent beneficiary and who can be named one? What does contingent beneficiary mean in life insurance? The primary beneficiary is at the head of the line.

The contingent beneficiary is behind that person and can only move forward if the primary beneficiary steps aside. Despite the term “primary, you may name more than one such beneficiary and designate how the assets will be divided among them. A contingent beneficiary, on the other han is the second in line to inherit your assets. If you name them both as primary beneficiaries, they would split the assets according to the percentages you have decided on.

Alternately, you may choose to name your spouse as the primary benef. See full list on legalzoom. You can choose just about anyone to inherit your assets in a living trust, life insurance policy, or retirement account as either a primary or contingent beneficiary—with one primary exception: the individual must have reached the age of majority under state law in order to receive the inheritance directly. Naming a minor as a beneficiary could send the issue to probate court—a situation that life insurance policies and retirement accounts are designed to avoid.

Note that no matter how much you adore your pet, they cannot be named a beneficiary. You could also name your favorite charity or nonprofit organization as a primary or contingent b. Remember that an estate plan is, rather ironically, a living and breathing document. That means you should review it regularly to make sure all of the provisions still communicate what you want to happen to your assets upon your death. Whenever you or loved ones experience a life event or change, such as a birth, marriage,.

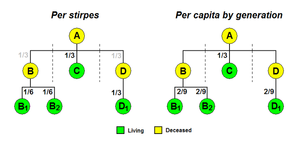

A primary beneficiary is simply first in line to receive the assets in the account, while the contingent beneficiary is next in line. There can be multiple primary and contingent beneficiaries, but contingent beneficiaries only receive their benefits in the event that none of the primary beneficiaries survive the account holder. A man passes away after accumulating $100in a retirement account. The account holder also named his three adult children as contingent beneficiaries.

It also might trigger a costly liquidation process. Many retirement accounts, for example, allow spousal beneficiaries to transfer an IRA into their own name and therefore delay required distributions until after age 70. Non-spousal beneficiaries, by contrast, are often required to begin taking distributions from the account immediately, which would lower the amount of time the assets can generate tax-differed growth. Common issues According to a recent study by the U. You can avoid these complications by taking the time to name primary and contingent beneficiaries when you open any financial account, and by periodically reviewing these designations to ensure that they still reflect your current wishes. You can change your beneficiaries at any time, unless it is for an irrevocable trust, which cannot be modified in this way.

Only people or certain types of entities can legally inherit from your will or other estate instrument. Beneficiaries are people or entities you designate to inherit from your estate when you pass. Likewise, if you leave property in your will to a minor, you need a legal guardian who can hold the property for the child until they reach the age of majority. You can have multiple primary beneficiaries and designate how much each receives. The amounts do not have to be equal.

For example, if you name three primary beneficiaries, you can divide the assets into one-third for each or designate lopsided percentages, such as , , and. On the other han if a primary beneficiary believes someone pressured you to split the assets because of duress or elder abuse, they can cl. They can only inherit if the primary beneficiaries all predecease you or cannot legally accept your bequests. If you need help deciding how to award your estate to beneficiaries, consult an estate attorney.

Parties with this beneficiary designation only receive the benefits if the primary beneficiaries can’t be foun can’t legally accept the inheritance, or predecease the account owner. Do You Need to Have Both? The first name is the primary (main) beneficiary.

The second name will be the contingent or secondary beneficiary. A primary life insurance beneficiary is someone who is the first person to receive death benefits from your insurance policy. In contrast, a contingent beneficiary will only receive benefits if the primary beneficiary dies. Assigning beneficiaries is an important part of estate planning. In order to ensure that your assets are divided according to your wishes, make sure that you understand the differences between primary beneficiary vs.

As with the primary beneficiary , you can have one or multiple contingent beneficiaries. Beneficiary designations are required on numerous types of financial accounts, such as retirement accounts and life insurance policies. A beneficiary is someone who is entitled to benefits in the event of someone else’s death. There are two types of beneficiaries , primary and contingent.

In other words, these beneficiaries are second in line behind your primary beneficiaries and inherit nothing as long as your primary beneficiaries accept their inheritance. The difference between a primary beneficiary and a contingent beneficiary is fairly simple: the primary beneficiary is first in line to receive the. Your primary beneficiary is first in line to the assets you leave from your estate.

After a primary beneficiary , the contingent beneficiary is next. Looking at an example may help. Let’s say you list your sister as a primary beneficiary to an asset and you list your brother as the contingent beneficiary.

Overall, this is why it’s important to not only name a primary beneficiary and contingent beneficiary , but to also review and update the beneficiary and his or her contact information periodically. Real Estate, Family Law, Estate Planning, Business Forms and Power of Attorney Forms. Primary beneficiary percentages must total 1 and contingent beneficiary percentages must total.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.