Wherever You Are In The World. Your Taxes Done With Ease. How do I Find my tax return? On the dotted line next to line or line (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ED67(e)”. Terms and conditions may vary and are subject to change without notice.

This interactive, free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file. Returns filed after October may be subject to late filing fees. Tax Return Filing Information. Consider the following information when filing tax returns : To file a state tax return , select a state and download state tax return income forms. You can also find state tax deadlines.

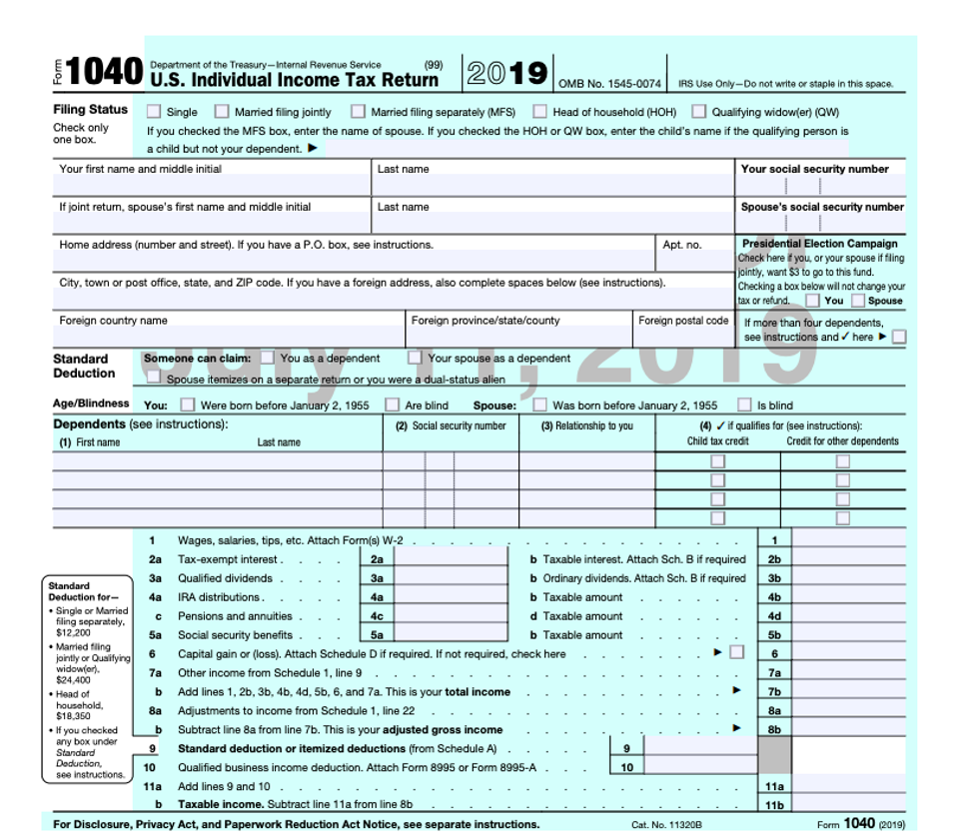

Dependents, Qualifying Child for Child Tax Credit, and Credit for Other Dependents. Total Income and Adjusted Gross Income. Instructions for Schedule 1. Efile your tax return directly to the IRS.

Prepare federal and state income taxes online. Prevent new tax liens from being imposed on you. The US is under an enormous strain right now because of the Corona Virus pandemic.

This unprecedented event has catapulted our economy into crisis mode. Tens of millions of Americans are without jobs and health insurance. People are struggling to pay for basic needs such as water and electricity. Save on Buy Turbo Tax Products.

Options to Pay Taxes. Step 1: Before you start e-Filing, download or print this page as you collect Forms, Receipts, Documents, etc. Free Federal Edition. Interest payments may be received. If your dependent is claimed on your tax return , they may still be required to file an income tax return of their own.

The requirements vary by filing status and age. Get the Latest in Buy Turbo Tax Products. Plenty of Buy Turbo Tax Products to Choose From. State Forms are not listed here.

The Tax Cuts and Jobs Act is the most significant set of changes to the U. However, in some previous years, the IRS has accepted tax returns early, or delayed the acceptance of returns , depending on technical issues. Not everyone has a simple return. After using our tax return estimator to calculate your taxes, you’ll need the right IRS forms to begin the tax filing process. This popular annual tax guide, written by Richard Hammar, J. CPA, includes sample tax returns for both active and retired ministers and step-by-step instructions for each.

This edition contains a special supplement addressing the current status of the parsonage and housing allowance. Department of Taxation and Finance. And for many, that refund is a substantial one. Did you withhold enough in taxes this past year?

Use this calculator to help determine whether you might receive a tax refund or still owe additional money to the IRS. Remember this is just a tax estimator so you should file a proper tax return to get exact figures. To successfully complete the form, you must download and use the current version of Adobe Acrobat Reader.

Complete, save and print your Individual Income Tax form online using your browser. Great Prices on Buy Turbo Tax Products. Call Today To Find Out How.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.