Only attach rent certificate if filing a homestead credit claim Do NOT sign your rent certificate. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! They help to get the housing field leveled out to give the home owner the opportunity to become an owner not a renter!

A homestead could be a room, A homestead could be a room, apartment, mobile or manufactured home, house, farm, or nursing home room. Select Form on the WI e-file selection page and then select Schedule H. Whether the property in question is residential or commercial, or the landlord wishes to create a long-term or short-term tenancy arrangement, the list below contains all the rental forms required to establish a written lease agreement. Rent Certificate Form Centrelink. Wisconsin Department of Revenue. Similar to Minnesota, you’ll need to obtain a rent certificate from your landlord before taking the credit.

Should you take the renters tax credit? Our verdict is that you should typically take the government up on offers of free money. Our focus on people, genuine relationships, and shared values has created a unique and defining company culture.

We care about our residents our expectation is to provide value and prompt service to all our tenants. The Residential Rental Practices Rule applies to business practices related to the rental of most residential dwelling units in this state. All landlords want their tenants to pay rent on time and without hassle.

CAUTIO N: Sche dule H or H-EZ m ust be com ple te d. To delete Schedule H in TurboTax Online: 1. Go to My Account in the top right corner. Under Tools Center select Delete a Form 4. HUD provides the following maximum HOME rent limits. The maximum HOME rents are the lesser of: The fair market rent for existing housing for comparable units in the area as established by HUD under CFR 888.

The credit, on the other han will be computed so long as. Note Example: A claimant files a claim with a rent certificate showing rent paid for occupancy of $20 or $6per month. Investigation by the Department of Revenue discloses the rent is too high for the locality and dwelling involve and the landlord is financially dependent on others for support and is related to the claimant. The CRP shows the amount of rent you paid and the amount of property taxes your unit is considered to have covered. You must have your CRP to determine your property tax refund and you will include it when filing your property tax return.

If the landlord decides to charge a late fee, we recommend charging a reasonable amount. Read more about late fees here. Tenants are legally entitled to a rental unit that meets basic structural, health, and safety standards.

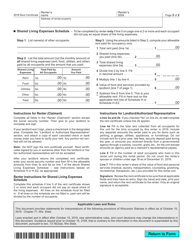

FMR is primarily used to determine the standard payment amounts for the Housing Choice Voucher program, rents for section housing contracts and deciding payment amounts for other government housing assistance programs. It is important to both tenants and landlords that rules ensure that these rental transactions are conducted fairly. State law provides a legal framework for the relationship between landlords and tenants. If your rent includes heat, multiply the amount by. If heat is not include multiply your rent by.

Finally, add lines 9b and 9d and write the total on line 10. You would use the same total factor for insurance, utilities and other shared expenses. Responsible Property Management At IHDA, we’re responsible for monitoring the properties we finance. That’s currently about 7multifamily rental properties that comprise more than 60units across the state.

Community-Based Residential Facility. A community-based residential care facility (CBRF) is a place where adults live and receive care, treatment or services that are above the level of room and board and may include up to three hours per week of nursing care.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.