Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Do you need NDA when hiring contractors? The one-way agreement is used when only one side will be sharing confidential information with the. These are great starting questions.

What does it protect in general? In short, a non-disclosure agreement is a legal document that protects your sensitive information. See full list on blog.

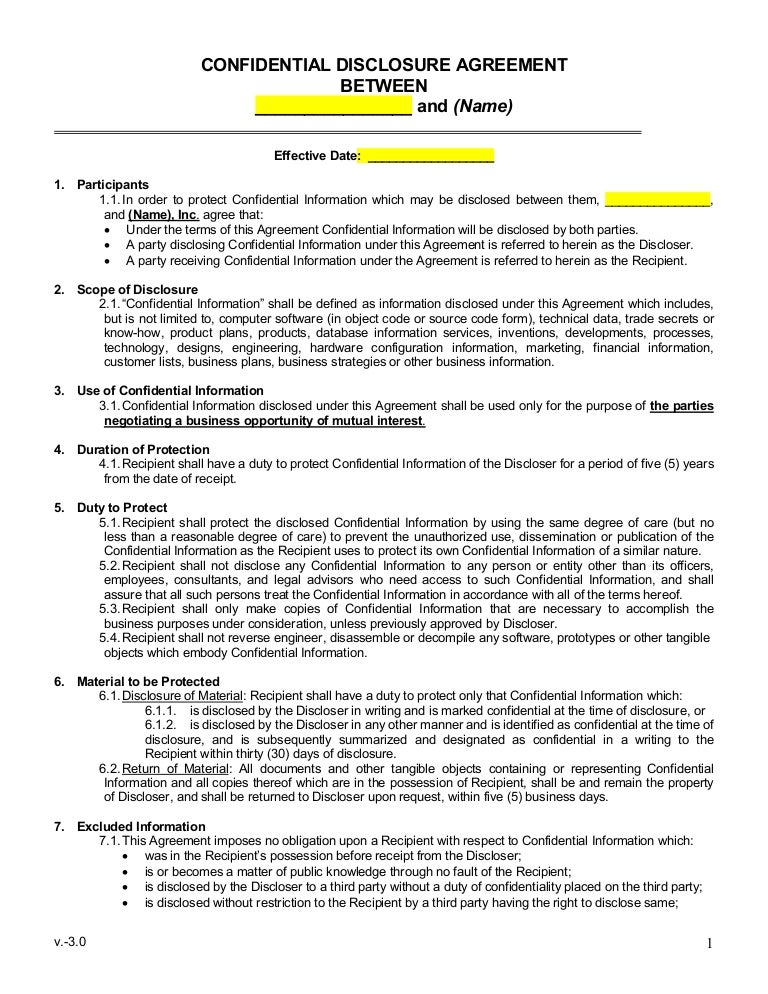

There are a lot of legally binding things that can go into any NDA. These should be thoroughly examined by your legal team before you sign. Some major parts include what is and what isn’t deemed confidential, what ‘parties’ are involve and things of that nature. According to Richard Harroch, from AllBusiness, a decent merger and acquisition non-disclosure agreement should cover the following: 1. Identification of the parties 2. Definition of what is deemed to be confidential 3. Who is responsible for issuing an NDA?

This seems like a simple question. To put it simply, NDAs are usually issued by whatever party has more at stake if information were to leak out. For example, in a merger, both parties will likely want to keep negotiations private until things are nailed down. In this situation, both parties are agreeing to join forces, making both of them more or less equal. However, during an acquisition, one party always has more at stake and it is often times the selle.

The key of any merger and acquisition non - disclosure agreement is to protect sensitive information, including the fact that a possible deal is even on the table. This is because one party is usually in a more precarious situation than the other. Negotiations should be kept private to ensure that both parties can speak freely and fairly.

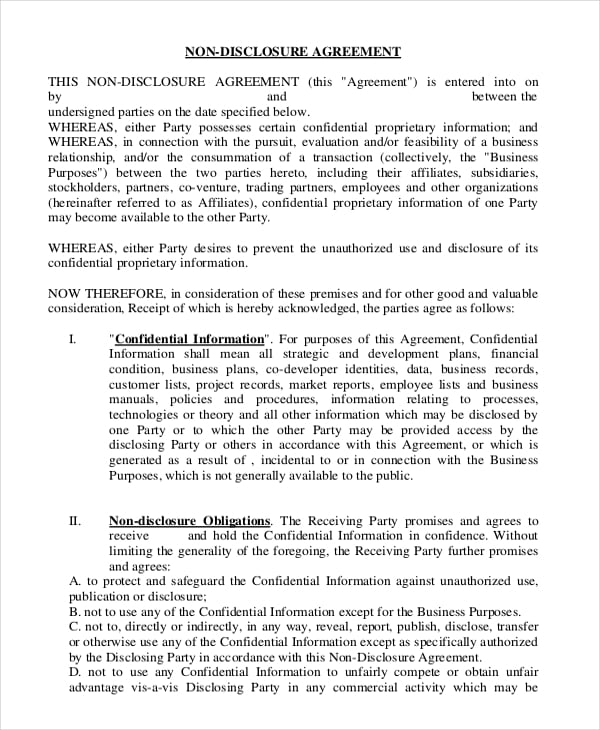

The exact details of the NDA, including what language is used inside the document, differs slightly for every instance they are used. Lean on the expertise of y. Non-Disclosure Agreements come in two basic formats: a one-way agreement or a mutual agreement. The mutual NDA form is for situations where each side may potentially share confidential information.

This BUSINESS SALE NON-DISCLOSURE AGREEMENT (hereinafter known as the “Agreement”) is entered into between ____________________ (hereinafter known as the “Company”) and _____________________ (hereinafter known as the “Potential Buyer”) for the purpose of sharing operational, financial and other information relating to the Company for the purpose of pursuing or establishing a business relationship or negotiating a contract between the parties. As a consequence, sellers will typically require any potential buyers to enter into a non-disclosure agreement (NDA) before the seller discloses any information to the potential buyer. A business sale non-disclosure agreement ( NDA ) is a legal contract or agreement formed by the seller and a possible buyer of a business that describes the confidential information a seller wants to disclose to that buyer with restrictions to third parties.

NDA is also known as Confidentiality Agreement (CA). The business sale non-disclosure agreement is used when you’re engaged in negotiations to purchase an entity. For example, merger or investment discussions, negotiations about joint ventures or talks with consultants or potential licensees. An NDA is very important and useful for the seller (Disclosing Party) as the seller is the one who is disclosing every piece of confidential information about the company. It faces more risk from others finding out about the information, as it may not generate positive sentiments from customers and employees.

For buyers, on the other han it is absolutely fine and normal to look for acquisitions and growth. Parties – The parties to the confidentiality agreement will be the potential buyer and seller. It describes the buyer as the “Receiving Party” and the seller as the “Disclosing Party. Need to generate a custom Non Disclosure Agreement in a fast, cheap way?

Visit EveryNDAto build your own NDA template instantly! To learn more about mergers and acquisitions, CFI offers the following resources. Confidential Information MemorandumCIM - Confidential Information MemorandumA Confidential Information Memorandum (CIM) is a document used in MA to convey important information in a sale process. Guide, examples, and template 2. It is a mutually binding contract 4. Merger Consequences AnalysisMerger Consequences AnalysisMerger consequences analysis assesses the financial impact a merger or acquisition may have.

Non - disclosure agreementsare legal contracts that prohibit someone from sharing information deemed confidential. The confidential information is defined in the agreement which includes, but not limited to, proprietary information, trade secrets, and any other details which may include personal information or events. Sample NDA: Non-disclosure or confidentiality agreement for asset purchase transaction. Confidentiality agreements, also known as non-disclosure agreements (NDAs), are used at the outset of discussions involving a business arrangement.

This is to safeguard IP before confidential information is shared. These agreements serve to safeguard a startup’s intellectual property (IP) before confidential information is shared. Agreements may be “one-side” allowing one party to reveal secret information, or “two-side” permitting both parties to share information. Company B will still be around to enforce the Agreement.

Purchasing or merging with another business is very complicated. You should consider hiring an. Make contact with the business.

When considering the purchase of a business , one of the first steps is to make. Consider a non - disclosure.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.