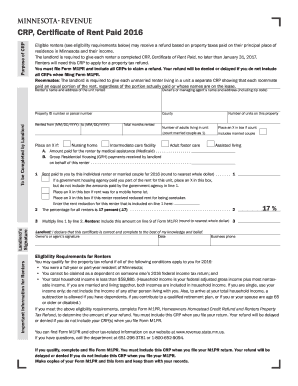

CRP for short-term or transitional care. Adult foster care homes. Enter the result on line 1. Press Done after you finish the form. Now you are able to print, save, or share the form. Once the registration part is over, you will get the Login credentials.

Next, you need to fill in your personal details, academic details, work experience details, etc. Upload scanned images of your photograph, and signature as per the. Certificate of Rent Paid ( CRP ) to each adult renter by January 3. The resulting number is the amount of property tax that the renter will.

Multiply that amount by or 0. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

Take full advantage of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web. Convert them into templates for multiple use, incorporate fillable fields to gather recipients? Whether or not each renter gets this refund depends on their specific income and rental amounts pai but since there is a possibility of a refun you are required to provide.

The state summary will show the state refund or balance due, and then the Property Tax Refund amount. I ordered the book- but would prefer not to wait if I. Schedule M1PR is filed separately from the individual income tax form. Fill out the top part of the form (name, address, SSN, date of birth).

Then type in the information from the paper CRP provided to you by your landlord. Form M1PR should now appear in the right-hand window. Martin Luther King, Jr. For many, this is a time-consuming task that consumes valuable time each and every year.

Minnesota Tax Court 2Minnesota Judicial Center Rev. For a list of all filing situations, see the M1PR instructions. If you want to file by regular mail, fill out the form , attach the CRP if you rent, and send it.

Be sure to verify that the form you are downloading is for the correct year. This educational activity is a. Include the corporation’s name and employer identification number on any attachments. Your browser appears to have cookies disabled.

Cookies are required to use this site. There are various factors that are used to determine whether or not a taxpayer qualifies for the credit. Offices can use the CCMS “Contracts that Expired on Sept. If forming a Public Benefit Corporation as a 302A and 304A, please note that forms are not available for this filing type. New articles must contain all the elements required for a business corporation and the additional 304A requirements in section 304A.

What if I had Two Renters During the Year? Reference Worksheet Instructions for guidance on CRP contract re-enrollment. A minimum of resource concern cause listed below must be present within the offer area to meet this element.

For specified agricultural or horticultural cooperatives (specified cooperatives), a deduction under section 199A(g) for income attributable to domestic production activities is.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.