Do I need to file GST? If you have no amounts to report you can file your return faster by selecting “I am filing a nil return (all fields are $0)” on the first Web form. Your return will then have $0.

To file your return , agree to the certification statement, and select “Submit”. Before you choose a metho you must determine if you are required to file online and which online method you can use. If your accounting software allows you to file your return directly with us, you can do this.

You can also download a paper return. For all other businesses located in Quebec, visit the Revenu Quebec web site. We issue your business activity statement about two weeks before the end of your reporting perio which for GST is usually every three months. How can I use the Returns Offline tool? Lodge your Grievance using self-service Help Desk Portal.

Wherever You Are In The World. Training Kit:Viewing and Tracking Returns. Also, interest is charged at per annum. This interest is calculated by the registered taxpayer on the amount of tax liability outstanding. A 15-digit GST identification number will be issued to you which is based on your state code and PAN number.

Next, you have to upload invoices on the GST portal or on software (the one you are using). This tool can be used by businesses to check whether their supplier has filed returns , particularly for checking when ITC not showing in GSTR-2A. Jump back to the top of the page top. Moving between Inland Revenue sites.

Therefore, to simplify the tax returns , the GST Council suspended the initial procedure of filing three monthly returns. Instea it demanded filing of GSTR and GSTR 3B only. It may sound problematic to meet up the regulations but with the GST experts’ proper online guidance in Online Legal India, you would be able to complete all the needful steps with ease. Uniform tax rates across different states are a boon for startups having a huge online presence and those into the e-commerce sector. Important Note: In GST Council meeting held on 22nd December it has been decided to bring one-time late fee waiver scheme.

Each of the following online options will step you through the process as you go: Online services for individuals and sole traders (accessed through myGov) – allows you to manage your tax and super in one. Tax Return s software for individuals and businesses to submit online return s to HMRC. Submit tax return s online to HMRC with Andica. GST returns filing for startups. Hi Friends, Learn how to add tax invoice to our GST Portal by this video.

Please share this video to our friends. In this video, we will discuss the various. The due date of your return is determined by your reporting period.

In your first return form GST - you had completed the details of all the sales and gave details of the GST deposited on them. Likewise, in the second return form, GSTR-had given details of all the purchases and the repaid GST on them. Now the third return form i. GSTR-3B will be a summary of both of these return forms. GST Return Filing in hours.

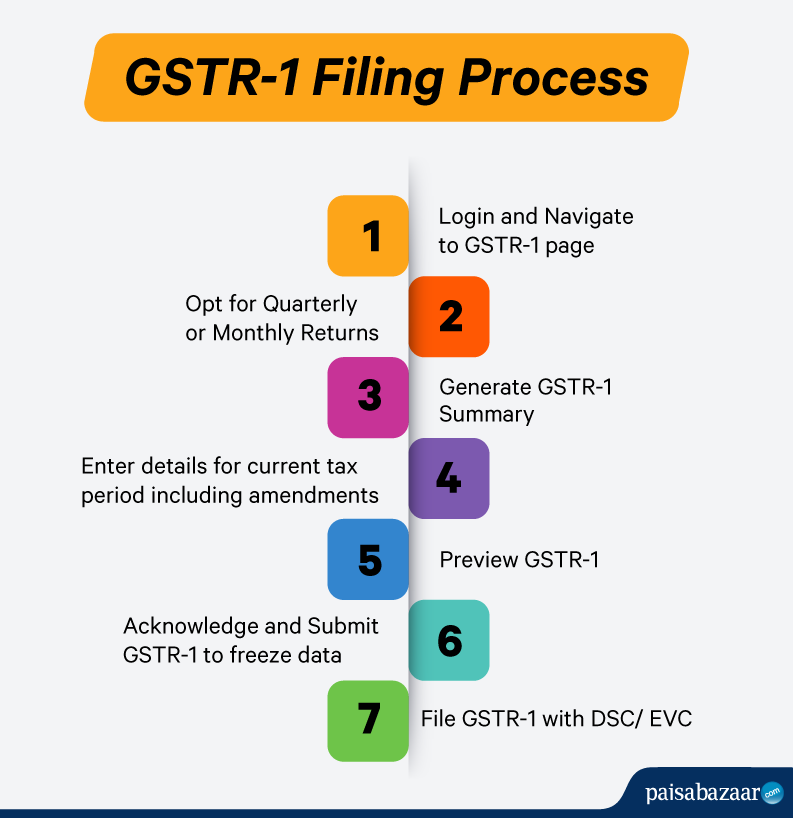

File the outward supply returns in GSTR-form through the information section at the GST Common Portal (GSTN) on or before the 10th of the following month. Those with annual turnover beyond 1. Every person registered under the GST Act has to periodically furnish the details of sales and purchases along with tax collected and paid thereon, respectively, by filing online returns. Before filing the return , payment of tax due is compulsory otherwise such return will be invalid. We attached all screenshots and divided into sections.

With KDK GST software, file all your returns from GSTRto GSTRon time and accurately. Generate completed returns by importing data from your existing software, excel or invoices generated within the KDK GST software, reconcile the invoices, validate the taxes. A representation is made to Finance Minister of India by Six Leading Associations of Chartered Accountants in India and it is requested to extend the due date for filing of returns for all the taxpayers for A.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.