What is a contingent beneficiary and who can be named one? What does contingent beneficiary mean in life insurance? Contingent beneficiaries effectively wait in the wings. A contingent beneficiary can be named in an insurance contract or a. You can also name a contingent beneficiary, who could receive the death benefit if something happened to the primary beneficiary. Think of a contingent beneficiary as your “alternate.

With most life insurance policies, you can change your beneficiary designation at any time. You can change your beneficiaries at any time, unless it is for an irrevocable trust, which cannot be modified in this way. Only people or certain types of entities can legally inherit from your will or other estate instrument. Likewise, if you leave property in your will to a minor, you need a legal guardian who can hold the property for the child until they reach the age of majority. See full list on info.

Primary beneficiaries are people, trusts, or charitable organizations to whom you want to leave your assets after you pass. You can have multiple primary beneficiaries and designate how much each receives. The amounts do not have to be equal. For example, if you name three primary beneficiaries, you can divide the assets into one-third for each or designate lopsided percentages, such as , , and.

On the other han if a primary beneficiary believes someone pressured you to split the assets because of duress or elder abuse, they can cl. They can only inherit if the primary beneficiaries all predecease you or cannot legally accept your bequests. If you need help deciding how to award your estate to beneficiaries, consult an estate attorney. If they are dead or if they die with you, your assets would instead go to any secondary beneficiaries you have designated.

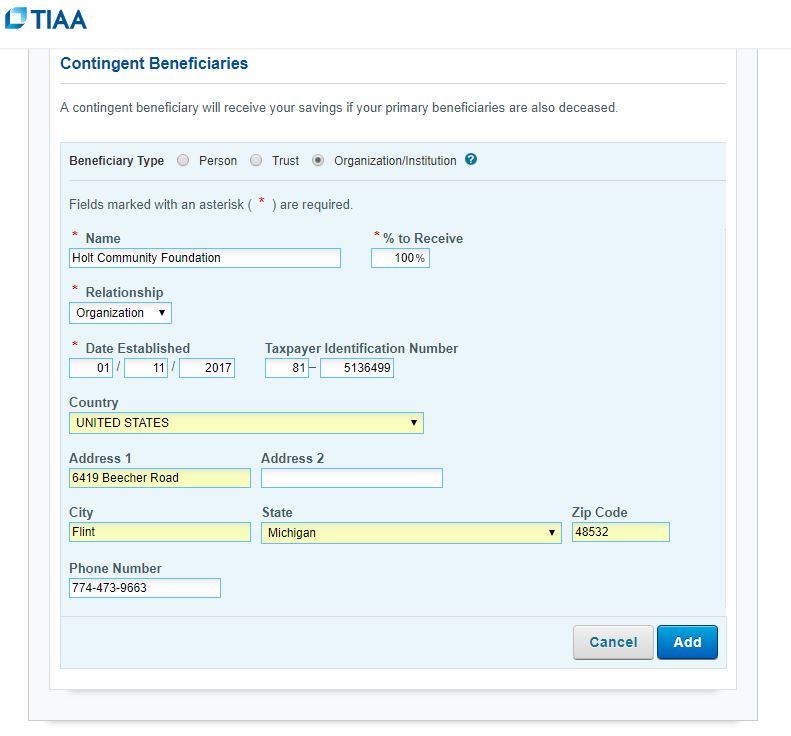

These secondary beneficiaries are often referred to as contingent beneficiaries on account forms. This is where the contingent designation comes in. The contingent is second in line after the primary.

If the primary beneficiary passes away before the account owner , the contingent beneficiary becomes the primary. Consider this as an added layer of protection to avoid the probate process. If all of the designated primary beneficiaries die before I do, any ordinary death or post retirement death benefit payable on my behalf shall be paid to the following. A primary beneficiary for one asset can be.

Look at your annual statement, check the online wizar or call the ThriftLine at 1. Beneficiary designations for 4(k)s override. Since your finances and assets will be distributed among named beneficiaries , the per stirpes and per capita rules apply. A beneficiary designation , however, is different.

Keywords new york state and local retirement system, nyslrs, employees retirement system, ers, police and fire retirement system, pfrs, members, designation of beneficiary with contingent beneficiaries , trust. If no beneficiary is selecte your death benefit will go to your estate. Name both primary and contingent beneficiaries. It’s a good practice to name a “back up” or contingent beneficiary in case the primary beneficiary dies before you. If there is only one individual that you want to leave the money to, consider whether a charity (or charities) would be appropriate as the contingent beneficiary.

An example is naming children with a trustee as contingent beneficiary on life insurance plans. If none of the named beneficiaries survive the account holders, and a named contingent beneficiary does not survive the account holders, his or her share will be divided equally among surviving contingent beneficiaries. CONTINGENT BENEFICIARIES on page PART 3. BENEFICIARY DESIGNATION I designate that upon my death, the assets in this account be paid to the beneficiaries named below.

The interest of any beneficiary that predeceases me terminates completely, and the percentage share of any remaining beneficiaries will be increased on a pro rata basis. Careless designations can lead to you do not want. For example, if you list your children by name as primary beneficiaries and a child dies before you, the benefit will be paid to your remaining children and not to your grandchildren by the deceased child even though the grandchildren are listed as. Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More!

All Major Categories Covered.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.