What is GST registration processing time ? What are the documents required for GST registration? How do I register for GST? Does GST registration really matter before purchase? We are known to provide GST registration in the least possible time.

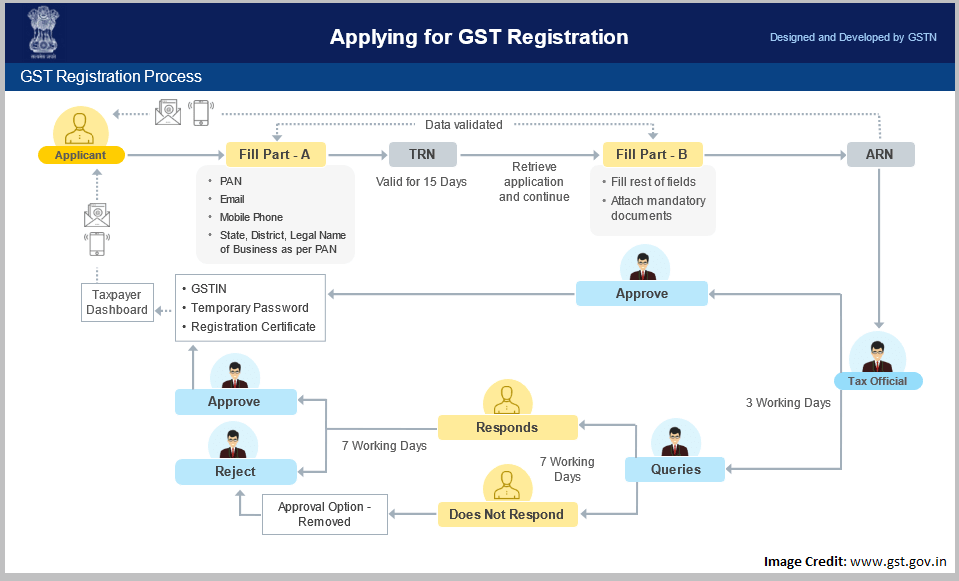

Within 3-working days, we will offer you the GSTIN number of your business. If the application has no deficiency or clarification, the proper officer has to grant GST within three working days. If not the application is deemed to be accepted and deemed to be registered.

The guide provided above for registering GST online on the GSTN portal can be of great help to you, especially if you are a first- time user and need help on how to register for GST online. Also, the process stated in the steps above is easy to follow. Time Limit for GST Registration: a. Days for Regular Person: Section 25(1) of the act states that every person who is liable to be registered shall apply for registration in every such State, where he is liable, within days from the date he becomes liable for registration. While the applicants not opting for Aadhaar authentication for GST registration would be granted only after physical verification of the place of business or documentary verification. It normally takes about working days for the provisional GSTIN to be provided and an additional days for providing final GSTIN with GST registration certificate.

If the processing officer approves the application, you will receive the GST registration certificate as a soft-copy. Why Did Your GST Registration Application Get Rejected? Step Four: GST Registration Application is Processed To facilitate the processing of your application, please ensure that your application is duly completed with the necessary supporting documents. We usually take working days to process your application. The Finance Ministry has smoothened the GST registration procedure to ease out the process of tax filing.

This is referred to as the GST registration process. North-Eastern states. The GST registration process can be completed within working days.

Last but not least – If you got any hassle during the process of GST registration in India, then get a free consultation on the same time by slotting an appointment with the best advisor from the ignite visible platform i. Process of aadhar authentication while applying for new GST registration in GST common portal. Given below is a brief look at the process. Use and processing of data: In case you choose to use services of gstregistrationonline.

If we ask you for more information, it will be on voluntary basis. We use this information to process and fulfill your service request, i. New GST registration , Amendment in GST etc. Mr Hari is Authorised signatory. Case 2: If you fail to obtain GST registration and the total tax evaded amounts to 0INR, the penalty applicable is 10INR. Errors in your GST registration ? If you have any mistakes or errors in GST registration , you can rectify it in the application for registration either at the time of registration or even afterwards.

Who needs to register for GST. You do not have to register GST just because you start a business or organisation. According to GST law, registration in GST should be done within days from that day. At the time of applying for GST registration , the applicant is given an option to select if he wishes to authenticate Aadhaar.

Registration under Goods and Service Tax ( GST ) regime will confer following advantages to the business: Legally recognized as supplier of goods or services. Proper accounting of taxes paid on the input goods or services which can be utilized for payment of GST due on supply of goods or services or both by the business. You only need to register for GST once, even if you operate more than one business.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.