Upon incorporation of your business, your legal identity is separated from the business. This ensures that the personal assets of the owner are protected should the business be unable to pay off its debts. Companies are a separate legal entity so it will be paying its own income tax.

This means that the profits of the business can remain in the company without it needing to be paid out to the owners. Thus, it allows family groups to minimise their tax without paying the highest marginal tax rates of as an individual. Investors and banks prefer to deal with Pty Ltd companies when it comes to funding and. See full list on boxas. Capital gains concessions, unfortunately, do not apply towards companies.

This concession allows for a discount for assets held for more than months or more at the time of being sold or when relevant capital gains may occur. Additionally, take into consideration the implications of directorshipresponsibilitieswhen setting up your company. These duties are regulated by the Australian Securities and Investment Commission (ASIC) and should be considered when making the decision to set up your business structure as a company. From a tax standpoint, setting up a discretionary trust is one of the most effective business structures.

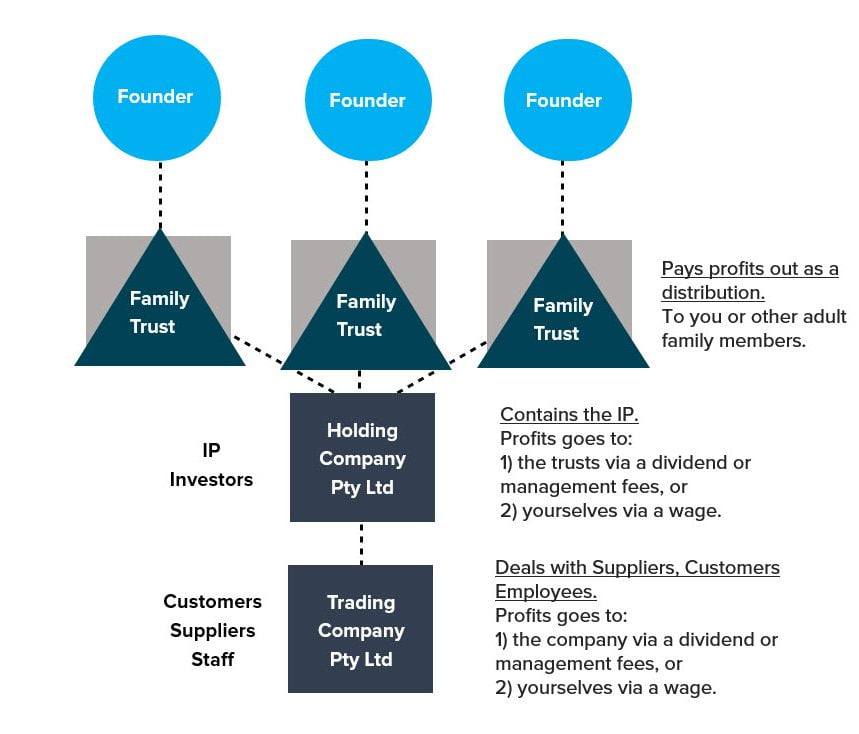

A discretionary trust means that the profits of the business can be distributed to a family member(s) so that the lowest possible individual marginal tax rates apply. This may not be evenly distributed and can be changed each time there is a distribution. Discretionary trusts also afford asset protection should your business no longer continue to operate due it not being able to pay off its debts.

Creditors of the business do not have any claims against assets that the trust owns. However, creditors directly towards the trust do have claims against these assets. Trust business structures are a much more complex and expensive process to establish than a company business structure. Secondly, a discretionary trust mustdistribute its profits to beneficiaries each financial year. Usually, a business that is going through a major growth stage, a company structure can be more appropriate due to lower tax rates on undistributed profits.

Thirdly, discretionary trusts usually involve family members as the parties are comfortable for a trustee to have discretion over distribution amounts each beneficiary receives. If your business is not a family business and operates with independen. Selecting your business structure between a Pty Ltd company vs trust can be tricky.

Considerations about the pros and cons need to be fully understood in order to make an accurate assessment of the suitability of each option. Each individual business owner’s situation can differ from one another and therefore. Only what is most suitable based on the business goals and what stage the business is at.

There is no bestoption. At Box Advisory Services, we always recommend that you consulta relevant accounting advisor to make sure you are making the most suitable decision for your business. to our monthly newsletter where we share exclusive small business and contractor advice! Disclaimer: Please note that every effort has been made to ensure that the information provided in this guide is accurate. You should note however, that the information is intended as a guide only, providing an overview of general information available to contractors and small businesses.

However, one of the main disadvantages of running your business through a company structure is that, unlike trusts, companies typically cannot access the general CGT discount. The only way to access this discount during a business exit is if there is a share sale by an eligible taxpayer, such as an individual or a trust. Trust and Company are two words that are often used in the sense of organization. They have shown some differences between them in terms of their functioning and characteristics.

A company is a form of business organization. It is a conglomeration of individuals and assets with a common aim towards the attainment of profits. Who is the trustee of a trust? Whilst trusts with individual trustees are certainly possible, the intergenerational nature of employing a company for this purpose means it is the popular entity for acting as a trustee.

What are the two types of trust? This has the non-trading company , which is the trustee company , and the family trust. But in the eyes of the tax office these here are seen as one and the same.

A trust can be set up to hold other investments for an individual or for investors. Typically, a trust structure is more expensive and complex to establish and maintain than a company structure. Problems may arise when trying to dissolve or alter an established trust. The trustee can distribute income at their discretion.

A trust is usually formed when a grantor (the creator of the trust ) feels that this organization can do a better job of managing an asset than an individual person. COMPARISON OF FAMILY TRUST vs OTHER STRUCTURES This chart is intended to provide a quick guide to factors bearing on the selection of trading and investment structures. Each structure is evaluated by reference to the same criteria, in order to allow for a ready comparison. In this type of trust unit holders accept or apply for units in the trust in a similar sense to shareholders obtaining shares in a company.

A Trust and a Limited Liability Company are two types of legal structures created at the state level, but are entirely different legal vehicles. Thread: financial structure LTC vs Trust vs Company. View Profile View Forum Posts. The five main types of trusts are living. The ownership structure of a private trust company varies based on circumstances, including family dynamics and tax considerations.

Here's how to find out which one is best for you. The structure should be evaluated for both the pros and cons related to each option.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.