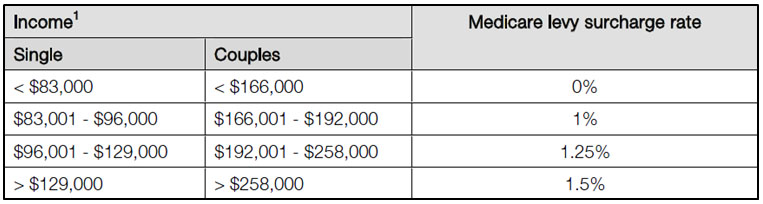

Do you pay medicare surcharge? Is medical surcharge payable? The surcharge rate is determined by an income test. Single incomes over $90or family incomes over $180have a surcharge rate of between and 1. This blog discusses the circumstances when the MLS becomes payable and how private hospital cover can avoid the Surcharge.

Medicare levy surcharge. It is a charge levied on medium and high income earners who do not have private hosptial cover. For calculating tax, your eligible to the tax free threshold based on the number of months you are an Australian tax resident. Then reduce this by the number of days you were not an Australian Tax Resident.

A$ 90(singles) and A$ 180(couples) subject to a number of adjustments and rules. To complete the form electronically, save a copy of the form before you start filling it in. Get Matched With Multiple Carriers.

Receive a Customized Free Quote. For the extra coverage you need. Enroll for the added benefits. Helps paying out-of-pocket costs. These are largely self-explanatory.

Select this checkbox to answer Yes. Non - residents only pay the medicare levy surcharge if they have Australian source income. The medicare levy surcharge is imposed on high income earners that do not have private health insurance.

However, if you were classed as a non. The current income threshold is $90for singles and $180for couples and families, including single parent families. Australian citizen medicare medicare levy medicare levy surcharge non-resident reciprocal health agreements resident Tax residency and tax implications for expat Australians To understand your tax situation, all Expat Australians must first work out if they are Australian or foreign residents for tax purposes. It provides free or subsidised cover for certain healthcare services, which means it pays all or part of the costs. A$90(singles) and A$180(couples) subject to a number of adjustments and rules.

This threshold is $90for individuals and $180for families. The ATO advises that while it’s usually , you may pay a reduced rate depending on your income. Non Australian Tax Residents are not liable for the medicare levy surcharge and therefore do not need to maintain private health insurance to avoid paying it.

If you want to stop paying your health insurance premiums you have two options : 1. Suspend Your Membership. Yes, you can offset the surcharge by getting health insurance that covers domestic hospitals in Australia. It was designed to encourage people to take out hospital cover earlier in life and encourage them to maintain it. Lifetime Health Cover. As well as your taxable income (such as income from your job, business or investments), other items are included such as reportable fringe benefits, reportable super contributions, and net investment losses.

In claiming home office expenses, taxpayers who run a business from their home will be able to claim more deductions for their home office than a taxpayer who simply works at home as a matter of convenience. An Australian resident , eligible for a Seniorstax offset, with a taxable income of $3738. If you don’t have the appropriate level of private hospital insurance, you may be charged an extra amount on top of the levy. While Australian tax residents are taxed on their worldwide income at a maximum current taxable rate of , (plus a medicare levy of an where applicable, a medicare levy surcharge ) when they become non - resident for tax purposes they become liable only for tax on Australian sourced income - an approach which differs from that of some.

As an Australian, you always have the right to health care. Residents have to declare all income earned in and out of Australia.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.