PHILADELPHIA RESIDENTS. Please read the special filing instructions on Page 11. Property Tax or Rent. FI) PA Department of Revenue. A portion of your rent is used to pay property taxes.

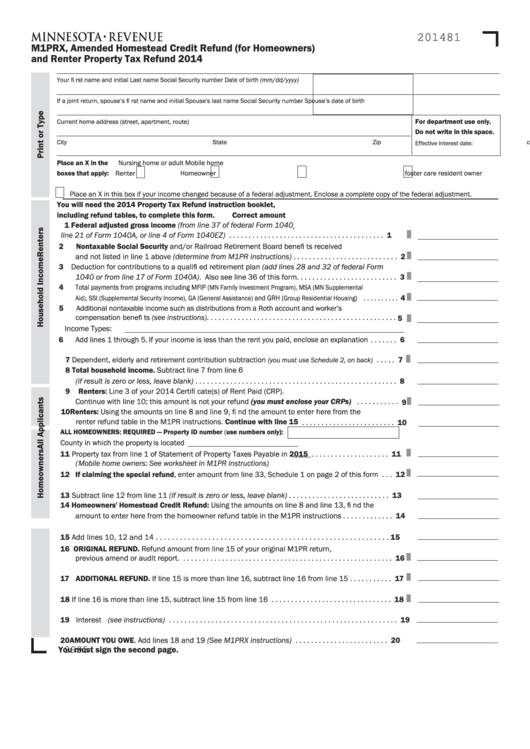

How can I file my renter rebate on my taxes? Where is my rebate check? When you file Form M1PR, you must attach all CRPs used to determine your refund. See the Form M1PR instructions for filing details.

The change affects those that received or paid alimony. The income limit is $30a year for homeowners and $10annually for renters , and half of Social Security income is excluded. Quote Online and Get Insured Today! Homeowners can qualify for one or two different types of refunds. Renters can qualify for a single refund.

Verification of Rent Paid. Landlord Information. For property held by you for personal use, you must subtract $1from each casualty or theft event that occurred during the. Include any separate amounts the renter paid to you for items such as parking, a garage, utilities, appliances, or furnishings. The credit is for a maximum of $7for renters and $1for owners who owned and occupied their home.

The actual credit is based on the amount of real estate taxes or rent paid and total household income (taxable and nontaxable). Enter the line amount on Form IT-20 line 67. The difference is the amount of the rebate.

Single person’s rebate is smaller than married person’s rebate. Rebate amounts can range from $50-$900. WHERE TO MAIL CLAIM Mail your completed Form MO-PTC and all attachments to: Department of Revenue. The advanced tools of the editor will direct you through the editable PDF template.

Enter your official contact and identification details. The municipal Claim Form (M-35c) is also available. The rebate amount is based on a graduated income scale and the amount the renter pays in rent and utilities.

Generally, the rebate amounts range between $- $900. Vermont – Vermont offers a rebate to renters making $40or less per year. Wisconsin – Wisconsin offers credit to renters with less than $26in household income. Similar to Minnesota, you’ll need to obtain a. Incomplete claims will delay processing.

You may be contacted for additional information. If you are not required to file a New York State income tax return, but you qualify for this credit, just complete and file Form IT-2to claim a refund of the credit. The above answer refers to Pennsylvanians.

Form M1PR requires you to list multiple forms of income, such as wages, interest, or alimony. The annual household income cannot exceed the amount specified by the legislature. Note: this amount changes each year.

The applicant must include all rent that has been paid. Tip: You can also file your M1PR free of charge at the MN Dept.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.