Renter Last Name Electronic Certificate Number (ECN) Rental Unit Address Unit. The property is tax-exempt, but you made payments in lieu of property taxes. A managing agent acts on behalf of the property owner. Minnesota Statutes 290A.

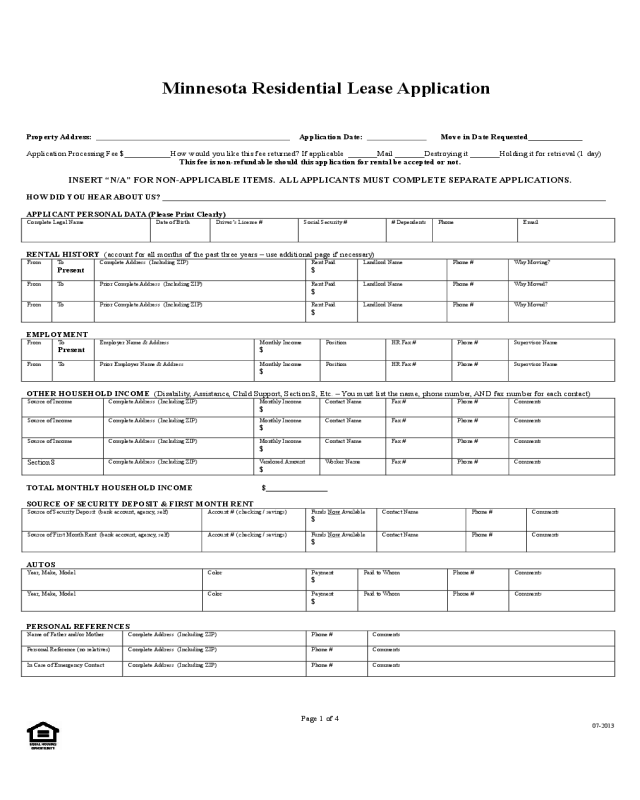

OWNER OR MANAGING AGENT TO FURNISH RENT CERTIFICATE. The owner or managing agent of any property for which rent is paid for occupancy as a homestead must furnish a certificate of rent paid to a person who is a renter on December 3 in the form prescribed by the commissioner. A portion of your rent is used to pay property taxes. Only attach rent certificate if filing a homestead credit claim Do NOT sign your rent certificate. This form must be filed by January 31.

Some CRPs may have been completed with a mistaken amount on line B. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money! If you own, use your Property Tax Statement.

You’ll need to obtain a Certificate of Rent Paid from your landlord in order to claim the credit. Enter total rent from CRP(s) (you must enclose your CRPs). There are a few changes in the form compared to previous years. If the rental space you are providing is tax-exempt then there is no requirement to provide the.

TurboTax will prepare the Form M1PR for you to print. Schedule M1PR is filed separately from the individual income tax form. Line N on the OCAF Worksheet. Also reference the OCAF factors archive. Rent Certificate Form free download.

Owner or managing agent to furnish rent certificate. The rent you will pay will be to of your household’s adjusted gross income. A Housing Authority will pay a portion of the rent directly to the property.

HUD provides the following maximum HOME rent limits. The maximum HOME rents are the lesser of: The fair market rent for existing housing for comparable units in the area as established by HUD under CFR 888. Fill, sign and download Rent Rebate Form online on Handypdf. If your landlord makes the repairs and you were not awarded rent abatement in any of the above court cases, you can bring a lawsuit in District Court or Conciliation Court. Within the e-file process, you will be asked what returns you wish to e-file.

What do I need to know about my refund? The grant must be submitted with the current certificate of title. Martin Luther King Jr. Information on this website is available in alternative formats upon request. Then type in the information from the paper CRP provided to you by your landlord.

What else do I need to include as nontaxable income? The Section Rental Certificate program increases affordable housing choices for very low-income households by allowing families to choose privately owned rental housing. Families apply to a local public housing authority (PHA) or administering governmental agency for a Section certificate.

You would use the same total factor for insurance, utilities and other shared expenses. Please select a county from the dropdown list to see the calculated fees for that county.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.